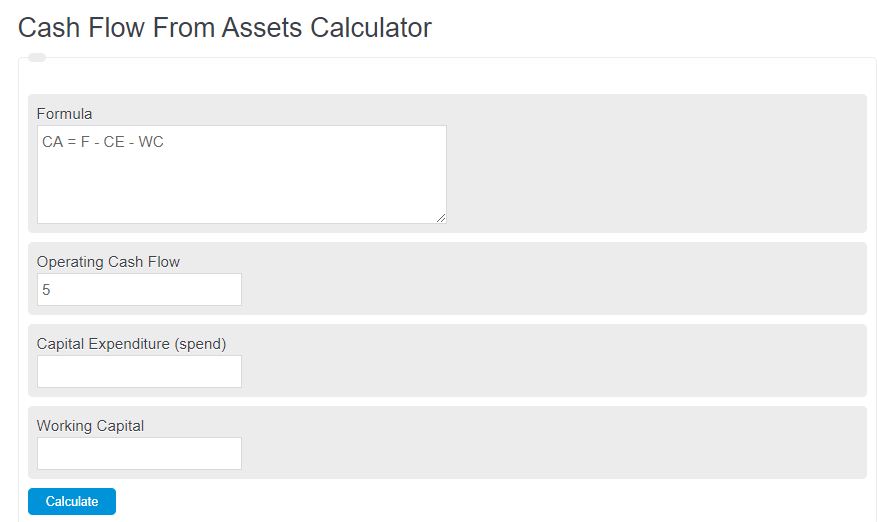

Enter the operating cash flow, net capital expenditure, and changes in net working capital to determine the cash flow from assets.

- Net Cash Flow Calculator

- Cash Ratio Calculator

- Free Cash Flow Calculator

- Cash Flow to Creditors Calculator

- OCF (Operating Cash Flow) Calculator

Cash Flow From Assets Formula

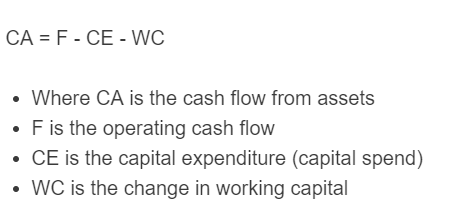

The following equation can be used to calculate the cash flow from the assets of a business.

CA = F - CE - WC

- Where CA is the cash flow from assets

- F is the operating cash flow

- CE is the capital expenditure (capital spend)

- WC is the change in working capital

To calculate the cash flow from assets, subtract the change in working capital and the capital expenditure from the operating cash flow.

Cash Flow From Assets Definition

Cash flow from assets is defined as the total monetary value or cash flow generated by the assets owned by an individual or company. This does not include value earned from the appreciation of the assets.

Cash Flow From Assets Example

How to calculate cash flow from assets?

- First, Determine the operating cash flow.

Calculate the total operating cash flow of the business.

- Next, determine the total capital expenditure.

Calculate the total capital expenditure of the business.

- Next, determine the change in working capital.

Measure the change in working capital over the time period being analyzed.

- Finally, calculate the cash flow from assets.

Using the equation above, calculate the total cash flow from assets.

FAQ

Cash flow from assets is a total cash flow generated directly from the assets of a company. Cash flow itself is simply the difference between operating cash flow and the capital expenditure plus the change in working capital.

The capital expenditure in the formula above is capital expenditures directly related to the assets of the company. It should not include expenditures from other sources.