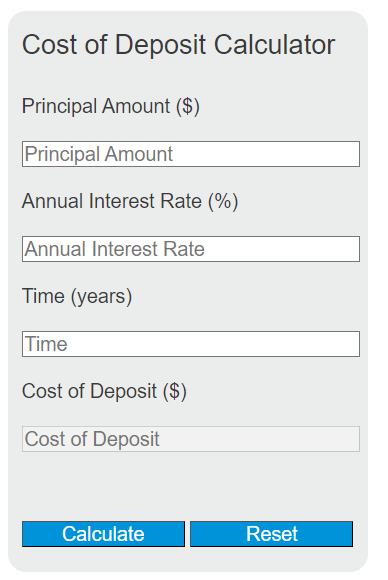

Enter the principal amount, annual interest rate, and time into the calculator to determine the cost of deposit. This calculator helps in understanding the cost associated with making a deposit over a certain period of time.

Cost of Deposit Formula

The following formula is used to calculate the cost of deposit.

CD = P * r * t

Variables:

- CD is the cost of deposit ($)

- P is the principal amount ($)

- r is the annual interest rate (as a decimal)

- t is the time the money is deposited for (years)

To calculate the cost of deposit, multiply the principal amount by the annual interest rate (as a decimal) and the time the money is deposited for.

What is Cost of Deposit?

Cost of deposit refers to the amount of money that is paid in interest for the use of the deposited funds over a certain period of time. It is a consideration for both the depositor and the financial institution, as it affects the net gain or expense associated with the deposit. This cost is typically calculated using the principal amount, the annual interest rate, and the time period of the deposit.

How to Calculate Cost of Deposit?

The following steps outline how to calculate the Cost of Deposit.

- First, determine the principal amount (P) that is deposited.

- Next, determine the annual interest rate (r) as a percentage.

- Convert the annual interest rate from a percentage to a decimal by dividing by 100.

- Next, determine the time (t) in years for which the money will be deposited.

- Use the formula CD = P * r * t to calculate the Cost of Deposit (CD).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Principal Amount (P) = $10,000

Annual Interest Rate (r) = 5%

Time (t) = 3 years