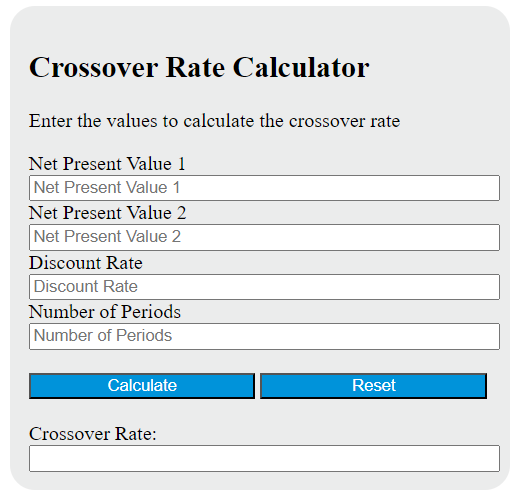

Enter all but one of the NPV1, NPV2, r, and n into the calculator to determine the crossover rate; this calculator can also evaluate any of the variables given the others are known.

Crossover Rate Formula

The following formula is used to calculate the crossover rate:

CR = (NPV1 * (1 + r)^n) / (NPV2 * (1 + r)^n - NPV1)

Variables:

- CR is the crossover rate

- NPV1 is the net present value of the first investment

- NPV2 is the net present value of the second investment

- r is the discount rate

- n is the number of periods

To calculate the crossover rate, multiply the net present value of the first investment by the discount rate raised to the power of the number of periods. Divide the result by the net present value of the second investment multiplied by the discount rate raised to the power of the number of periods, subtracting the net present value of the first investment from the numerator.

What is a Crossover Rate?

The crossover rate is a specific point on the cost of capital curve in the field of corporate finance. It is the rate at which two comparable projects have the same net present value (NPV). In other words, it is the rate at which the NPV of one project equals the NPV of another project. The crossover rate is used in capital budgeting to compare the desirability of projects. It is particularly useful when comparing projects of different sizes or lengths. The crossover rate helps to identify which project would be more profitable under different circumstances. For instance, if the cost of capital is below the crossover rate, one project would be more profitable, but if the cost of capital is above the crossover rate, the other project would be more profitable.

How to Calculate Crossover Rate?

The following steps outline how to calculate the Crossover Rate:

- First, determine the initial investment for Project A ($).

- Next, determine the initial investment for Project B ($).

- Next, gather the formula from above = CR = IRR(A) – IRR(B).

- Finally, calculate the Crossover Rate.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Initial investment for Project A ($) = 5000

Initial investment for Project B ($) = 4000