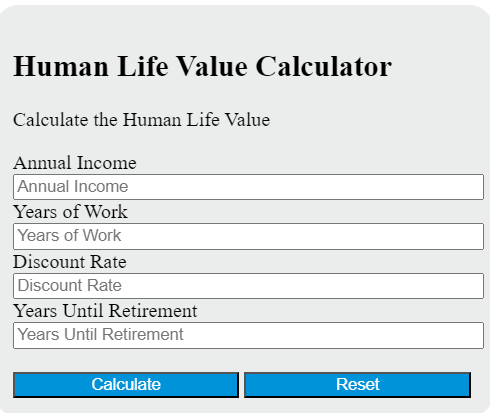

Enter all but one of the individual’s annual income, the number of years the individual is expected to work, the discount rate, and the number of years until retirement into the calculator to determine the Human Life Value; this calculator can also evaluate any of the variables given the others are known.

Human Life Value Formula

The following formula is used to calculate the Human Life Value (HLV):

HLV = (I * E * (1 + r)^n) / ((1 + r)^n - 1)

Variables:

- HLV is the Human Life Value

- I is the individual’s annual income

- E is the number of years the individual is expected to work

- r is the discount rate or the rate of return on investment

- n is the number of years until retirement or the expected remaining years of work

To calculate the Human Life Value, multiply the individual’s annual income by the number of years the individual is expected to work, then raise the result to the power of the number of years until retirement. Add 1 to the discount rate and raise it to the power of the number of years until retirement. Divide the first result by the second result, and subtract 1 from the quotient.

What is a Human Life Value?

Human Life Value (HLV) is a concept in insurance and economics that calculates the financial value or economic value of a human life. This value is determined based on the individual’s income, expenses, debts, and future financial responsibilities. The HLV is used to determine the amount of life insurance a person should have to ensure their dependents or beneficiaries are financially secure in the event of their death. It takes into account the individual’s current income, their age, their expected retirement age, inflation, and expected rate of return on investments. The HLV is not a measure of a person’s worth or value in emotional, social, or other non-economic terms but rather a tool to assess financial risk and plan for financial security.

How to Calculate Human Life Value?

The following steps outline how to calculate the Human Life Value:

- First, determine the individual’s annual income ($).

- Next, determine the number of years the individual is expected to work.

- Next, calculate the individual’s total income over their working years by multiplying the annual income by the number of years.

- Next, determine the individual’s expenses and subtract them from the total income to calculate the individual’s savings.

- Next, determine the individual’s expected rate of return on investments.

- Next, calculate the present value of the individual’s savings by discounting them based on the expected rate of return.

- Finally, calculate the Human Life Value by adding the present value of savings to any additional financial obligations or debts.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Annual income ($) = 50,000

Number of years working = 40

Expenses ($) = 30,000

Expected rate of return (%) = 5

Additional financial obligations or debts ($) = 20,000