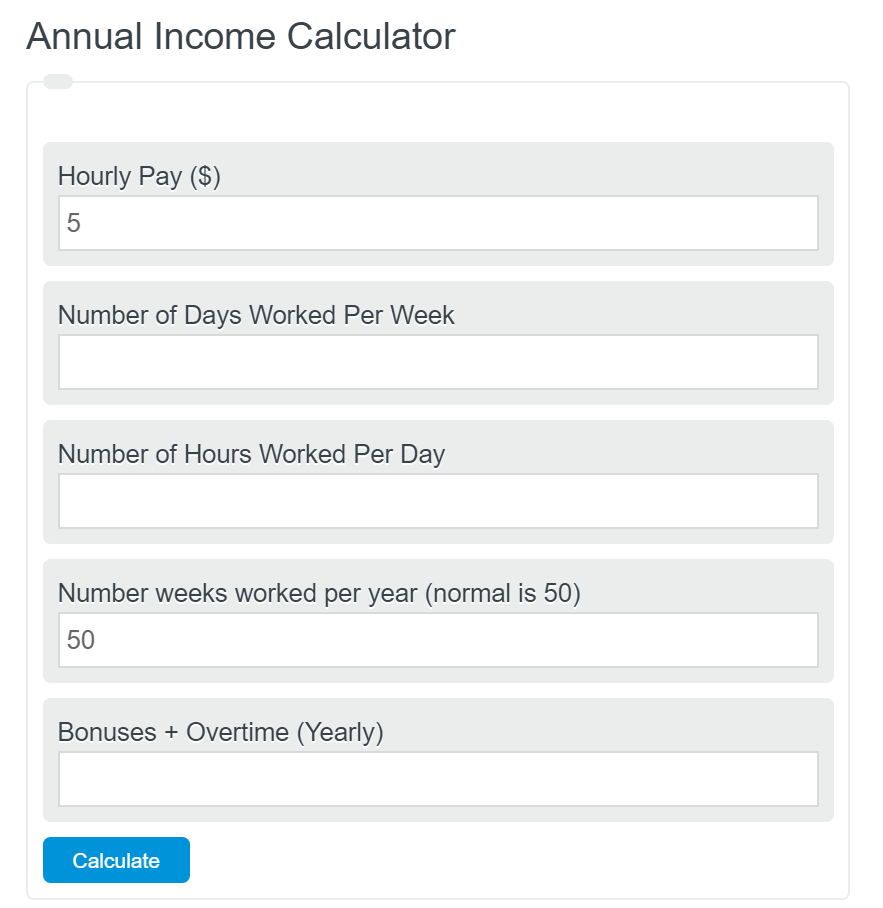

Enter your hourly rate, days per week worked, # of weeks worked per year, and hours per day into the annual income calculator. The calculator will return your equivalent annual salary.

- Disposable Income Calculator

- Net Worth Calculator

- Salary Inflation Calculator

- Bill Rate Calculator

- Emergency Fund Calculator

- Daily Rate Salary Calculator

- Average Weekly Wage Calculator

- Quarterly Wage Calculator

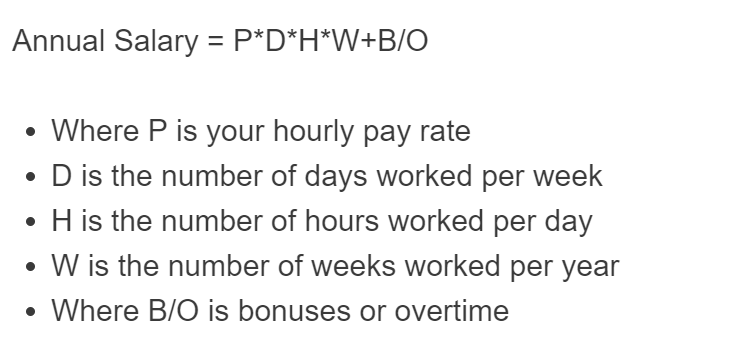

Annual Income Formula

The following calculator can be used to calculate your hourly to salary rate.

Annual Salary = P*D*H*W+B/O

- Where P is your hourly pay rate

- D is the number of days worked per week

- H is the number of hours worked per day

- W is the number of weeks worked per year

- Where B/O is bonuses or overtime

To calculate the annual income, multiply the days per week, hours per day, weeks per year, and hourly rate together, then add in bonuses and overtime.

Annual Income Definition

Annual income is defined as the annual salary before taxes an individual earns on a yearly basis.

How to calculate annual income?

How to calculate annual income from hourly

- First, determine your hourly pay rate and working time

Your working time will include days per week, hours per day, and weeks per year. On average the number of weeks worked per year is around 50 weeks. The other 2 weeks are vacation. If you have vacation pay for these days, enter your weeks as the full 52 weeks.

- Next, determine any additional bonuses or overtime

This will be included in your annual income. All money received from your employer should be considered in your annual income.

- Calculate your annual income

Enter all of the information into the formula above to calculate your equivalent annual income.

FAQ

How do bonuses and overtime affect annual income calculations?Bonuses and overtime are additional earnings on top of the base salary or hourly wage. When calculating annual income, these should be added to the total after multiplying your hourly rate by the number of hours worked per year. This ensures the calculation reflects the total earnings more accurately.

Can annual income vary even with a fixed hourly rate?Yes, annual income can vary despite having a fixed hourly rate due to factors such as the number of hours worked (which can fluctuate if you work overtime or fewer hours some weeks), bonuses received, and any unpaid time off taken throughout the year.

Why is understanding your annual income important?Understanding your annual income is crucial for budgeting, financial planning, and making informed decisions about savings, investments, and expenditures. It helps in assessing your financial health, planning for taxes, and evaluating job offers or salary negotiations.