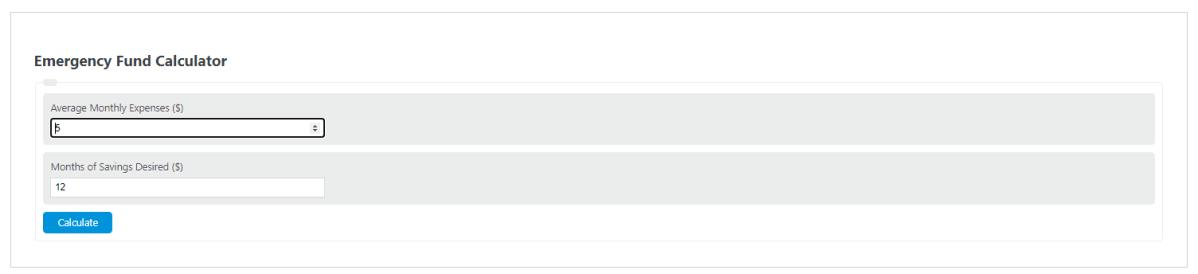

Enter your average monthly costs and your desired months of savings into the calculator to determine your emergency fund?

- Disposable Income Calculator

- Annual Income Calculator

- Residual Income Calculator

- Home Affordability Calculator (28/36 rule)

- Savings Rate Calculator

Emergency Fund Formula

The following formula is used to calculate the total amount needed for an emergency fund.

EF = AC * MS

- Where EF is the emergency fund amount ($)

- AC is your average monthly costs($)

- MS is your desired months of savings for emergencies ($)

Emergency Fund Definition

An emergency fund refers to a designated amount of money set aside for unexpected financial crises or unforeseen circumstances. It acts as a safety net to provide financial stability and peace of mind during times of uncertainty.

Life is unpredictable, and unexpected events like medical emergencies, job loss, or major car repairs can occur without warning.

During such situations, having an emergency fund can make a significant difference. It serves as a financial buffer, allowing individuals to cover immediate expenses without resorting to debt or depleting their regular savings.

By having an emergency fund, individuals can avoid the stress and anxiety associated with financial instability. It provides a sense of security, knowing they are prepared to face unexpected challenges. Without this fund, people may find themselves vulnerable, relying on high-interest loans or credit cards, leading to long-term financial struggles.

How many months of savings should I have for an emergency fund?

In general, most the most suggested amount for an emergency fund is 6 months of costs. This can be difficult for some people, so 3 months is sometimes presented as the absolute minimum.

How to calculate an emergency fund?

First, determine your total monthly costs. This can be done by tracking your expenses for an entire month or taking your expenses for a year and dividing by 12. It’s generally suggested that for determining your expenses, include only expenses that are necessary or nearly necessary for continuing to live.

For this example problem, the average monthly cost of this person $5,000.00.

Next, determine the number of months of expenses needed for the emergency fund. In this example, we will use the simple 6 months of expenses.

Finally, calculate the emergency fund amount using the formula above:

EF ($) = AC * MS

= $5,000 * 6

= $30,000.00.

FAQ

What is the primary purpose of an emergency fund?

An emergency fund serves as a financial safety net designed to cover unexpected expenses or financial emergencies without the need to incur debt. It provides financial stability and peace of mind during times of uncertainty.

How can I calculate my average monthly costs for the emergency fund formula?

To calculate your average monthly costs, track your expenses for a month or take your annual expenses and divide by 12. Include only necessary or nearly necessary expenses for living, such as housing, utilities, food, and transportation.

Is it better to keep my emergency fund in a savings account or invest it?

It’s generally recommended to keep your emergency fund in a savings account or a similar liquid, low-risk account. This ensures that the funds are readily accessible and not subject to market fluctuations or penalties for early withdrawal.

Can the size of an emergency fund vary depending on personal circumstances?

Yes, the size of an emergency fund can vary based on personal circumstances, such as job stability, number of income sources, and personal comfort level. While a common recommendation is to save 3-6 months’ worth of expenses, some may choose to save more or less based on their specific situation.