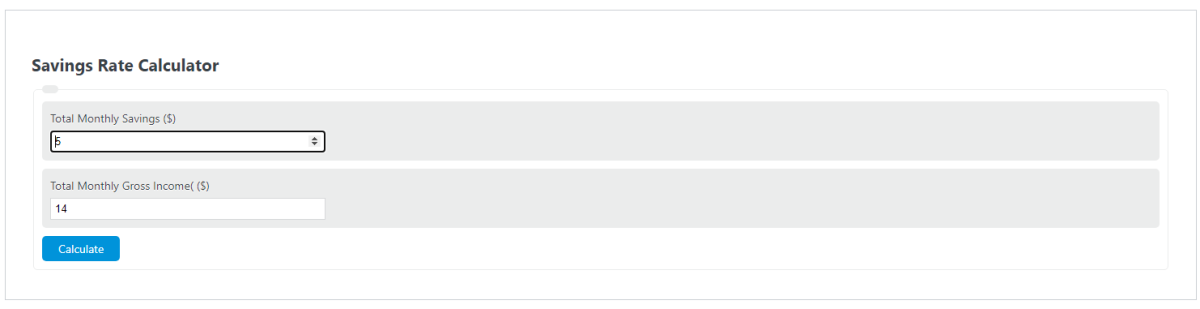

Enter the total monthly savings and monthly gross income into the calculator to determine your savings rate.

- Private Savings Calculator

- High Yield Savings Account Calculator

- Disposable Income Calculator

- Emergency Fund Calculator

Savings Rate Formula

The following formula is used to calculate a savings rate:

SR = MS/MI *100

- Where SR is the savings rate (%)

- MS is the montly savings ($)

- MI is the monthly gross income ($)

Savings Rate Definition

The savings rate refers to the proportion of one’s saved income instead of being spent. It represents the percentage of money that individuals or households set aside for future use or emergencies.

By calculating the savings rate, one can determine how much of their income is saved relative to their total earnings.

Understanding the savings rate is crucial as it directly impacts an individual’s financial well-being and long-term stability.

A higher savings rate implies that a larger portion of income is being saved, allowing for greater financial security and flexibility in the future. It enables individuals to build an emergency fund, invest in assets, or achieve specific financial goals such as buying a house or saving for retirement.

A higher savings rate facilitates wealth creation and financial independence. By consistently saving a significant portion of their income, individuals can accumulate assets and investments that generate additional income over time.

This can include investments in stocks, bonds, real estate, or retirement accounts. As these assets grow, they contribute to an individual’s overall net worth and can provide financial security in retirement.

What is a good savings rate?

In general, a savings rate of anything above 15% is considered extremely good. The higher a person’s income, the higher their savings rate should be.

Example Problem

How to calculate a savings rate?

- First, determine the total monthly gross income.

For this example, we are looking at a household with monthly incomes of $4000 and $6000 from the heads of the household respectively. This leads to a total income of $10,000.00.

- Next, determine the total monthly savings amount.

In this case, the household is only able to save $1000.00.

- Finally, calculate the savings rate.

Using the formula above, the savings rate is calculated as:

SR = MS/MI *100

SR = 1000/10000 *100

SR = 10%.

FAQ

What factors can influence an individual’s savings rate?

Several factors can influence an individual’s savings rate, including income level, living expenses, financial obligations (such as debt), lifestyle choices, and financial goals. A higher income and lower living expenses typically allow for a higher savings rate, while significant financial obligations or lifestyle choices that require higher spending can reduce the amount available to save.

How can someone improve their savings rate?

Improving a savings rate can be achieved by increasing income (through higher-paying jobs, side hustles, or passive income streams), reducing unnecessary expenses, budgeting effectively, and setting clear financial goals. Additionally, automating savings can ensure a consistent savings rate by transferring a set amount of money to savings or investment accounts each month.

Why is having a good savings rate important for financial health?

A good savings rate is crucial for financial health as it helps build an emergency fund to cover unexpected expenses, reduces reliance on debt, and enables long-term financial goals such as retirement savings, homeownership, or investing. A higher savings rate provides financial security and flexibility, allowing individuals to navigate financial challenges more effectively.

Can the savings rate impact the economy?

Yes, the aggregate savings rate of a population can significantly impact the economy. A higher savings rate can lead to increased investment in businesses and infrastructure, potentially driving economic growth. However, if the savings rate is too high, it might lead to reduced consumer spending, which can slow economic growth. Balancing savings and spending is crucial for the health of the economy.