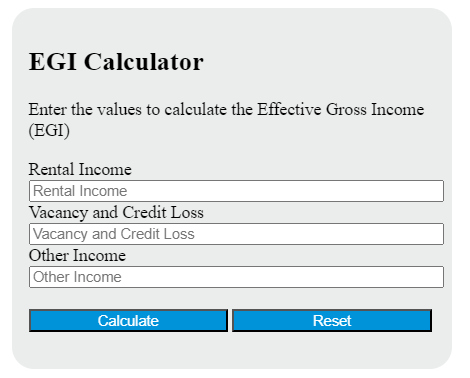

Enter the Rental Income (R) and Other Income (O) into the calculator to determine the Effective Gross Income (EGI); this calculator can also evaluate any of the variables given the others are known.

- Net Percentage Calculator (Net/Gross Income)

- AGI Calculator (Adjusted Gross Income)

- Gross Potential Rent Calculator

Egi (Effective Gross Income) Formula

The following formula is used to calculate the Effective Gross Income (EGI):

EGI = (R - V) + O

Variables:

- EGI is the Effective Gross Income

- R is the Rental Income

- V is the Vacancy and Credit Loss

- O is the Other Income

To calculate the Effective Gross Income, subtract the Vacancy and Credit Loss (V) from the Rental Income (R), and then add the Other Income (O).

What is an Egi (Effective Gross Income)?

Effective Gross Income (EGI) is a financial metric used in real estate to determine the potential income of a property. It is calculated by adding the property’s annual gross rental income to any other income generated by the property, such as parking fees or laundry machine revenue, and then subtracting any vacancy and credit losses. EGI is an important figure for property owners and investors because it provides a more accurate picture of a property’s income potential than gross rental income alone. It takes into account not only the money brought in by renting out the property but also any additional income streams and the potential for lost income due to vacancies or non-payment.

How to Calculate Egi (Effective Gross Income)?

The following steps outline how to calculate the Effective Gross Income (EGI).

- First, determine the rental income ($).

- Next, add any additional income sources ($).

- Next, subtract any vacancy and credit loss ($).

- Finally, calculate the Effective Gross Income.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Rental income ($) = 5000

Additional income sources ($) = 1000

Vacancy and credit loss ($) = 500