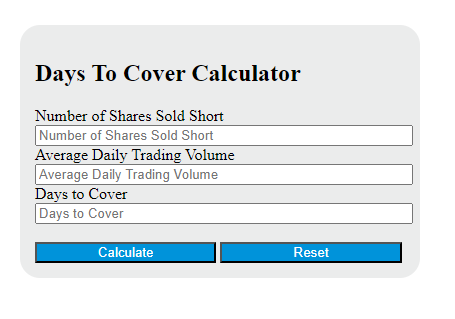

Enter the number of shares sold short and the average daily trading volume into the calculator to determine the Days to Cover. This calculator can also evaluate any of the variables given the others are known.

Days To Cover Formula

The following formula is used to calculate the Days to Cover.

DTC = SS / ADV

Variables:

- DTC is the Days to Cover

- SS is the number of shares sold short

- ADV is the average daily trading volume

To calculate the Days to Cover, divide the number of shares sold short by the average daily trading volume. The result is the number of days it would take for all short sellers to cover their positions if the price of the stock begins to rise. A higher Days to Cover ratio can indicate a higher potential for a short squeeze, which can lead to a rapid increase in a stock’s price.

What is a Day to Cover?

Days to Cover, also known as short ratio, is a financial metric used to understand the liquidity of a company’s shares. It measures the number of days it would take for all short sellers to cover their positions if the price of the stock begins to rise. The ratio is calculated by dividing the number of shares sold short by the average daily trading volume. A higher days to cover ratio can indicate a higher potential for a short squeeze, which can lead to a rapid increase in a stock’s price.

How to Calculate Days To Cover?

The following steps outline how to calculate the Days To Cover.

- First, determine the number of shares sold short (SS).

- Next, determine the average daily trading volume (ADV).

- Next, gather the formula from above = DTC = SS / ADV.

- Finally, calculate the Days To Cover.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Number of shares sold short (SS) = 500

Average daily trading volume (ADV) = 1000