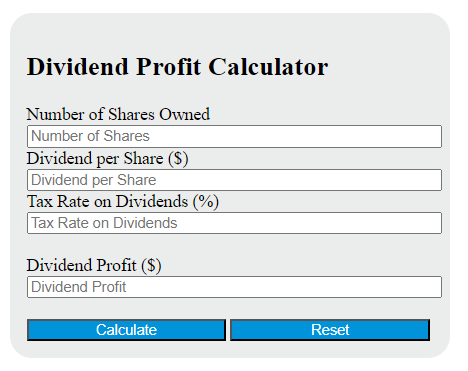

Enter the number of shares, dividend per share, and tax rate into the calculator to determine the dividend profit.

Dividend Profit Formula

The following formula is used to calculate the dividend profit.

DP = (S * D * T) / 100

Variables:

- DP is the dividend profit ($)

- S is the number of shares owned

- D is the dividend per share (in dollars)

- T is the tax rate on dividends (in percentage)

To calculate the dividend profit, multiply the number of shares owned by the dividend per share. Then multiply the result by the tax rate on dividends. Finally, divide the result by 100 to get the dividend profit.

What is a Dividend Profit?

A dividend profit is the income that a shareholder earns from a company’s dividend payments. Dividends are a portion of a company’s earnings that are distributed to shareholders, typically on a regular basis. The amount of dividend profit a shareholder receives depends on the number of shares they own and the dividend rate set by the company. This profit is considered a return on investment for shareholders and is separate from any capital gains they may earn from selling their shares.

How to Calculate Dividend Profit?

The following steps outline how to calculate the Dividend Profit.

- First, determine the number of shares owned (S).

- Next, determine the dividend per share (D) in dollars.

- Next, determine the tax rate on dividends (T) in percentage.

- Next, gather the formula from above = DP = (S * D * T) / 100.

- Finally, calculate the Dividend Profit.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

number of shares owned (S) = 500

dividend per share (D) = 2.5

tax rate on dividends (T) = 15%