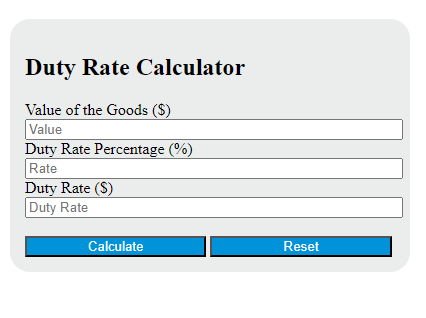

Enter the value of the goods and the duty rate percentage into the calculator to determine the duty rate. This calculator can also evaluate any of the variables given the others are known.

Duty Rate Formula

The following formula is used to calculate the duty rate.

DR = (V * r) / 100

Variables:

- DR is the duty rate ($)

- V is the value of the goods ($)

- r is the duty rate percentage (%)

To calculate the duty rate, multiply the value of the goods by the duty rate percentage. Then, divide the result by 100 to convert the percentage to a decimal. The result is the amount of duty that will be charged on the goods.

What is a Duty Rate?

A duty rate is a tax imposed by a government on imported or exported goods. Its purpose is to protect domestic industries from foreign competition by increasing the cost of foreign goods. The rate can be fixed or variable, depending on the type of goods and the country of origin or destination. It is typically calculated as a percentage of the value of the goods (ad valorem), but it can also be based on the quantity or weight of the goods.