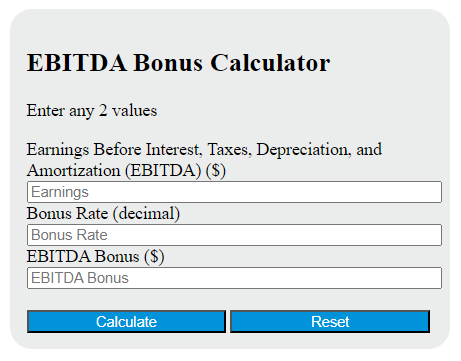

Enter the Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) and the bonus rate into the calculator to determine the EBITDA bonus. This calculator can also evaluate any of the variables given the others are known.

Ebitda Bonus Formula

The following formula is used to calculate the EBITDA bonus.

B = (E * r)

Variables:

- B is the EBITDA bonus ($)

- E is the Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) ($)

- r is the bonus rate (decimal)

To calculate the EBITDA bonus, multiply the Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) by the bonus rate. The result is the EBITDA bonus.

What is an Ebitda Bonus?

An EBITDA bonus is a type of incentive given to employees, usually executives, based on the company’s earnings before interest, taxes, depreciation, and amortization (EBITDA). It is designed to motivate employees to improve the company’s financial performance, as the bonus amount is directly tied to the company’s EBITDA. The higher the EBITDA, the larger the bonus payout. This type of bonus is common in industries with significant assets and depreciation expenses, such as manufacturing and real estate.

How to Calculate Ebitda Bonus?

The following steps outline how to calculate the EBITDA Bonus.

- First, determine the Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) ($).

- Next, determine the bonus rate (decimal).

- Next, gather the formula from above = B = (E * r).

- Finally, calculate the EBITDA Bonus.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) ($) = 500

Bonus rate (decimal) = 0.1