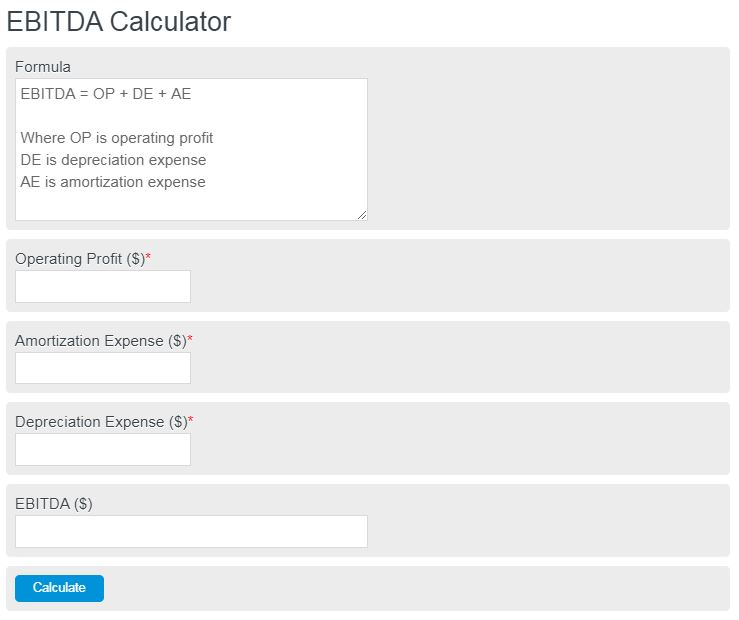

Calculate the earnings before interest, taxes, depreciation, and amortization using this calculator. Enter the operating profit, amortization expense, and depreciation expense.

- Quick Ratio Calculator

- Current Ratio Calculator

- PVIFA Calculator

- VAT Calculator

- EBT (Earnings Before Tax) Calculator

EBITDA Formula

The EBITDA can be calculated with the following formula:

EBITDA = OP + DE + AE

- Where OP is operating profit

- DE is depreciation expense

- AE is amortization expense

All of these values are unitless. This means you can use any currency and the equation still works.

EBITDA Definition

EBITDA, as explained above, is similar to EBIT but it takes into account deprecation and amortization. The purpose of EBITDA is to understand and compare the profit and earnings of companies from different locations and countries. This provides a more balanced outlook on business success.

How to calculate EBITDA

We will now look at an example of how you might calculate the EBITDA of a given company.

- First, we need to determine the current operating profit of that business. This is done by taking the total revenue and subtracting the total costs, which include material, labor, etc. Say we wind this company has an operating profit of $1,000,000.00.

- Next, we need to determine the depreciation expense. We find that this company has a depreciation expense of $5,000.00.

- Next, we need to determine the amortization expense. This is the expense due to interest. We find that the company has an amortization expense of $100,000.00.

- Finally, we plug all of these values into the equation above:

- EBITDA = $1,000,000.00 + $5,000.00 + $100,000.00 = $1,105,000.00

FAQ

Why is EBITDA important in financial analysis?

EBITDA is a key indicator used in financial analysis to assess a company’s operational profitability without the effects of financial and accounting decisions. It allows for a more direct comparison of the performance between different companies by eliminating the impacts of financing and accounting decisions.

Can EBITDA be used to compare companies from different countries?

Yes, EBITDA can be an effective tool for comparing companies from different countries, as it removes the effects of tax environments, financing structures, and accounting practices, providing a clearer view of operational performance.

How does EBITDA differ from net income?

EBITDA focuses on earnings before interest, taxes, depreciation, and amortization, providing insight into the operational profitability of a company. In contrast, net income includes these factors, reflecting the company’s total profitability after all expenses and income taxes.

Is it possible for a company to have a positive EBITDA and a negative net income?

Yes, a company can have a positive EBITDA and still report a negative net income. This situation may occur if the company has high interest expenses, tax liabilities, or significant depreciation and amortization expenses that outweigh its operational profits.