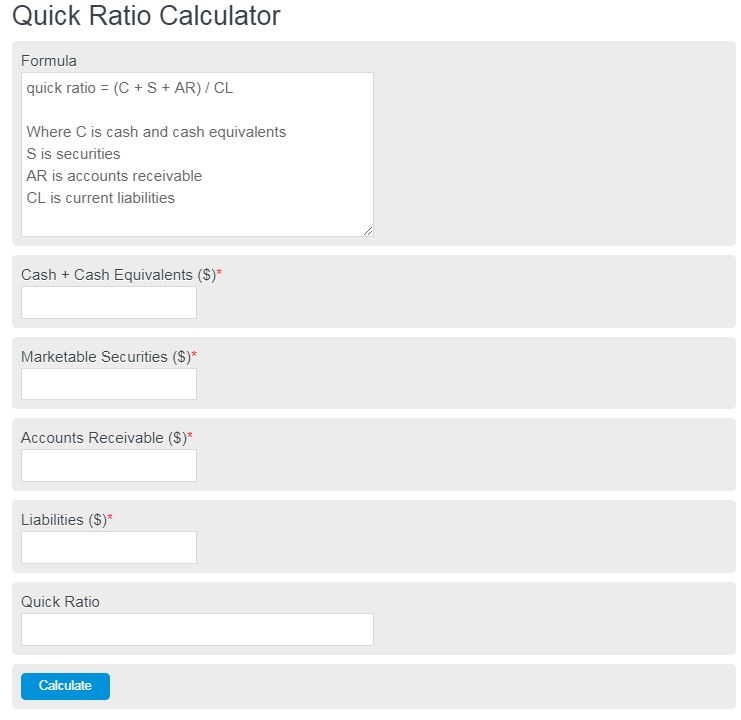

Calculate the quick ratio of your business using this calculator. Enter your total cash (and cash equivalent), marketable securities, accounts receivable, and current liabilities.

Quick Ratio Formula

The following formula is used to calculate the quick ratio of a company.

quick ratio = (C + S + AR) / CL

- Where C is cash and cash equivalents

- S is securities

- AR is accounts receivable

- CL is current liabilities

Quick Ratio Definition

Quick Ratio is a financial metric that measures a company’s ability to cover its short-term liabilities with its most liquid assets.

How to calculate quick ratio?

Here’s an example of how you can use this calculator or formula to calculate the quick ratio of a business.

- First, you must take the measure of all of your cash. This includes cash equivalents. Let’s say you find you currently have $10,000,000.00 in cash.

- Next, you need to measure your marketable securities. This will be a measure of the current value of those securities, not potential future value. Let’s say you have $5,000,000.00 in securities.

- Next, you must take account of all of your current account’s receivable, or pending invoices. Let’s say you have $2,000,000.00.

- Finally, you need to calculate your total liabilities. This includes all outstanding loans, payments, etc. Let’s assume you have $10,000,000.00 in liabilities.

- Plug all of these into the calculator and you get a quick ratio of 1.7. Anything above 1 is considered a great quick ratio. That means no matter what, you can pay off your debts.

FAQ

What does the quick ratio indicate about a company’s financial health?

The quick ratio indicates a company’s ability to meet its short-term obligations with its most liquid assets without needing to sell inventory. A higher ratio suggests better financial health and liquidity.

Why are cash equivalents, marketable securities, and accounts receivable included in the quick ratio?

These assets are included in the quick ratio because they are considered the most liquid assets a company has. They can be quickly converted into cash, making them crucial for covering short-term liabilities.

How does the quick ratio differ from the current ratio?

The quick ratio is more conservative than the current ratio because it excludes inventory and other less liquid current assets from its calculation. This makes the quick ratio a stricter measure of a company’s immediate liquidity.

Is a higher quick ratio always better?

While a higher quick ratio indicates better liquidity, an excessively high ratio may suggest that a company is not effectively using its assets to grow. It’s important to find a balance that reflects both security and efficient asset utilization.