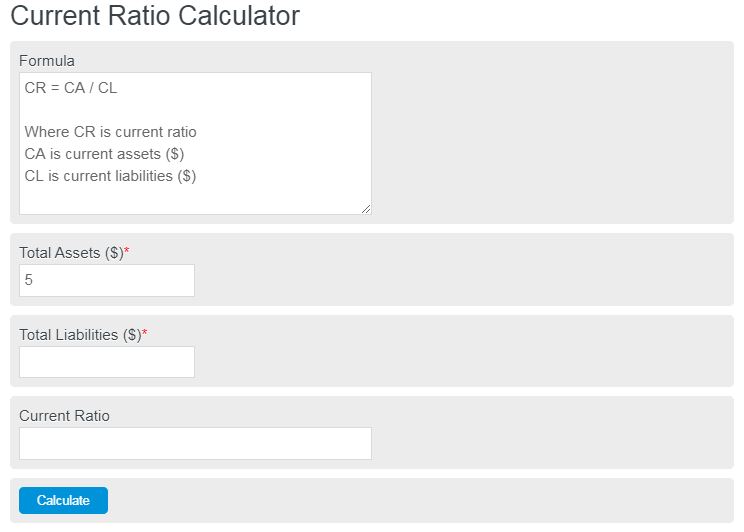

Enter the total current assets of your business or individual, as well as the total liabilities to calculate the current ratio. The current ratio is a measure of the liquidity of a business.

- Quick Ratio Calculator

- Deadweight Loss Calculator

- Maximum Revenue Calculator

- Current Liabilities Calculator

Current Ratio Formula

The current ratio of a business can be calculated with the following equation:

CR = CA / CL

- Where CR is the current ratio

- CA is current assets ($)

- CL is current liabilities ($)

Where assets and liabilities are measured in currency and the ratio is unitless.

What is a Current Ratio?

A current ratio is a metric used to assess a company’s ability to pay off its short-term liabilities with its short-term assets. It is calculated by dividing the total current assets of a company by its total current liabilities. This ratio represents the company’s liquidity position and indicates its ability to meet its short-term obligations.

A high current ratio suggests a company has enough assets to cover its current liabilities, indicating a strong liquidity position. This implies that the company is well-prepared to handle its short-term financial obligations, such as paying off creditors or meeting operating expenses. On the other hand, a low current ratio may indicate a potential risk of financial instability, as the company may struggle to meet its short-term obligations.

The current ratio is important for investors, creditors, and management as it provides insights into a company’s financial health and ability to manage short-term obligations. It helps investors gauge the company’s ability to generate sufficient cash flows to cover its immediate liabilities. Creditors also use the current ratio to assess the risk of extending credit to the company.

How to calculate the current ratio?

Let’s look at an example of how current ratio is calculated.

- Let’s assume you an owner of a business. First, you need to calculate your total assets. This includes all types of assets, including cash, physical goods, property, etc. Once we calculate this, we find your business has $100,000.00 in assets.

- Next, we need to calculate the total liabilities of your company. This includes debts, loans, outstanding payments, etc. We find your company has $50,000.00 in liabilities.

- Finally, we need to divide assets by liabilities and we find you have a current ratio of 2.0. That’s great! You’re in good shape.

FAQ

Why is the current ratio important for a business?

The current ratio is important because it provides insights into the financial health of a business, specifically its liquidity and ability to meet short-term obligations. A healthy current ratio indicates that a business can comfortably cover its short-term liabilities with its short-term assets, which is crucial for operational stability and financial flexibility.

What is considered a good current ratio?

A good current ratio varies by industry, but generally, a ratio between 1.5 and 3 is considered healthy. A ratio above 1 indicates that the company has more current assets than current liabilities, suggesting it can pay off its debts in the short term. However, a very high ratio may also indicate that a company is not efficiently using its assets to grow its business.

How can a company improve its current ratio?

A company can improve its current ratio by increasing its current assets or decreasing its current liabilities. Strategies to increase current assets include improving accounts receivable collection processes, selling unused equipment, or increasing sales. To decrease current liabilities, a company can pay off current debts or negotiate longer payment terms with suppliers.

Can a high current ratio be a bad sign?

While a high current ratio generally indicates good liquidity, an excessively high ratio may suggest that a company is not effectively using its assets to generate revenue or growth. It could mean the company is holding too much cash or other assets rather than investing in profitable ventures. Therefore, while a good current ratio is essential, it should be balanced with other financial performance measures.