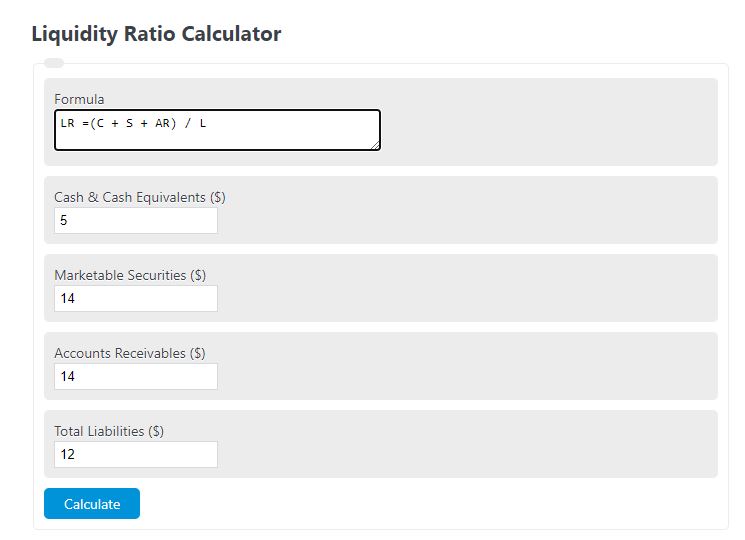

Enter the cash & cash equivalents, marketable securities, accounts receivable, and current liabilities into the calculator to determine the liquidity ratio.

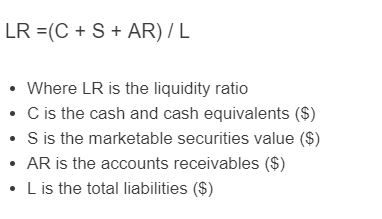

Liquidity Ratio Formula

The following formula can be used to calculate the liquidity of a company.

LR =(C + S + AR) / L

- Where LR is the liquidity ratio

- C is the cash and cash equivalents ($)

- S is the marketable securities value ($)

- AR is the accounts receivables ($)

- L is the total liabilities ($)

To calculate the liquidity ratio, sum the cash, securities value, and accounts receivable, then divide by the total liabilities.

Liquidity Ratio Definition

Liquidity ratio is a financial metric that assesses a company’s ability to meet its short-term obligations using readily available assets. It measures the company’s ability to convert its assets into cash quickly, without incurring significant losses, to cover its upcoming liabilities.

This ratio is crucial for businesses as it provides insights into their financial health and ability to handle financial obligations in the short term.

By understanding the liquidity ratio, stakeholders such as investors, lenders, and suppliers can evaluate a company’s risk profile and make informed decisions about their engagement with the business.

A high liquidity ratio indicates that a company has sufficient liquid assets to meet its short-term liabilities comfortably. This implies a stronger financial position, as the company can readily settle its debts and operational expenses without resorting to external borrowings or selling fixed assets.

A low liquidity ratio indicates a potential risk for a company. Having a smaller proportion of liquid assets in relation to its liabilities means that the company may face difficulties in fulfilling its short-term obligations. This could lead to liquidity constraints, delayed payments to suppliers, or even bankruptcy if the situation persists.

Liquidity Ratio Example

How to calculate the liquidity ratio?

- First, determine the cash on hand.

Calculate the amount of cash and cash equivalents the business has on hand.

- Next, determine the marketable securities.

Calculate the value of all securities that could be sold on short notice.

- Next, determine the accounts receivable.

Measure the total accounts receivable for the year.

- Next, determine the total liabilities.

Calculate the total liabilities.

- Finally, calculate the liquidity ratio.

Using the formula presented above, calculate the liquidity ratio.

FAQ

What factors can affect a company’s liquidity ratio?Several factors can impact a company’s liquidity ratio, including changes in accounts receivable, fluctuations in cash flow, variations in current liabilities, and the sale or purchase of marketable securities. Economic conditions and operational efficiency also play significant roles.

How often should a company calculate its liquidity ratio?It’s advisable for companies to calculate their liquidity ratio regularly, such as monthly or quarterly. This frequent assessment helps in monitoring financial health and making informed decisions promptly to address any liquidity concerns.

Can a high liquidity ratio be negative for a company?While a high liquidity ratio indicates that a company can easily meet its short-term obligations, an excessively high ratio may suggest that the company is not using its assets efficiently. This could mean that too much capital is tied up in liquid assets, which could be otherwise invested to generate higher returns.

What is the difference between liquidity ratio and solvency ratio?The liquidity ratio measures a company’s ability to cover its short-term obligations with its current assets, focusing on the short-term financial health. In contrast, the solvency ratio evaluates a company’s ability to meet its long-term debts and obligations, providing a longer-term perspective on financial stability.