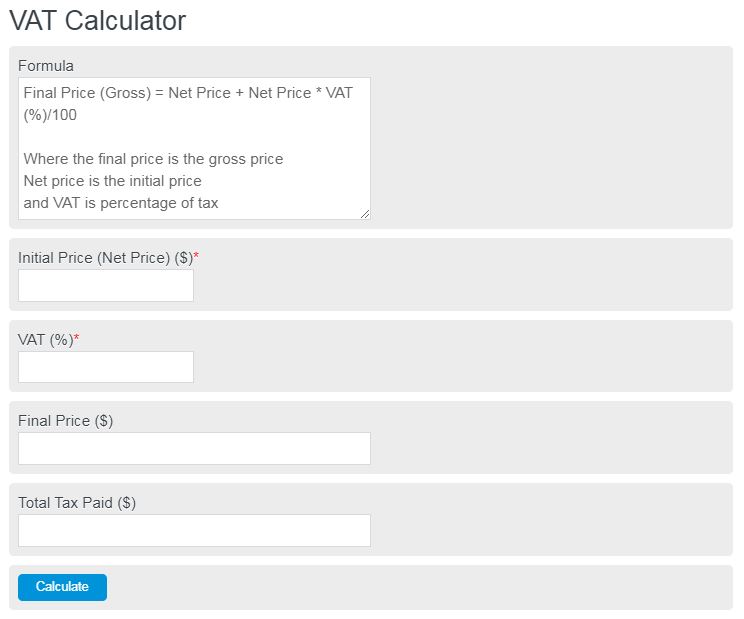

Calculate the total gross pay and tax amount due to the value-added tax using this VAT calculator. This calculator evaluates the total tax amount and the corresponding gross price.

- Reverse Sales Tax Calculator

- EBITDA Calculator

- PVIFA Calculator

- Depreciation Tax Shield Calculator

- AMT (Alternative Minimum Tax) Calculator

VAT Formula

The formula for the value-added tax is the same as for any other tax.

Final Price (Gross) = Net Price + Net Price * VAT (%)/100

- Where the final price is the gross price

- Net price is the initial price

- VAT is the percentage of tax

The difference in VAT as opposed to GST is that the value-added tax is used on the final consumption of goods. That is, it’s entirely linked to the consumer’s point of purchase or moment of sale.

VAT Definition

Value Added Tax (VAT) is a consumption tax imposed on the sale of goods and services at each stage of production and distribution. Unlike traditional sales taxes levied only at the final point of sale, VAT is collected incrementally at multiple stages of the supply chain.

It is designed to be a fair and efficient way to generate government revenue.

VAT taxes the value added to a product or service at each stage of its production or distribution. It is based on the principle that businesses should pay tax on the value they add to goods or services rather than on the total selling price.

The tax is collected by businesses at each stage of the supply chain and remitted to the government. Ultimately, the burden of the tax is borne by the final consumer who pays the VAT on the product or service they purchase.

The importance of VAT lies in its ability to generate substantial revenue for governments. By taxing a wide range of goods and services consumed by individuals and businesses, VAT provides a reliable source of income that can be used to fund public services and infrastructure development.

It is an important tool for governments to finance their expenditures and fulfill their responsibilities towards society.

How to calculate VAT

Let’s look at an example of how you might use this calculator to evaluate your final price and tax amount.

Let’s assume you are looking to buy a new kitchen table. After going through the options, you find one that is selling for $1,000.00.

Next, we need to determine what the VAT is. Let’s assume that the tax is 4%. Now we plug these values into the formula above.

Gross Price = $1,000.00 + $1,000.00*4/100 = $1040.00.

The total tax amount you paid is therefore, $40.00.

FAQ

VAT is short for value added tax and it is a tax applied to all goods that are resold after value as been added.