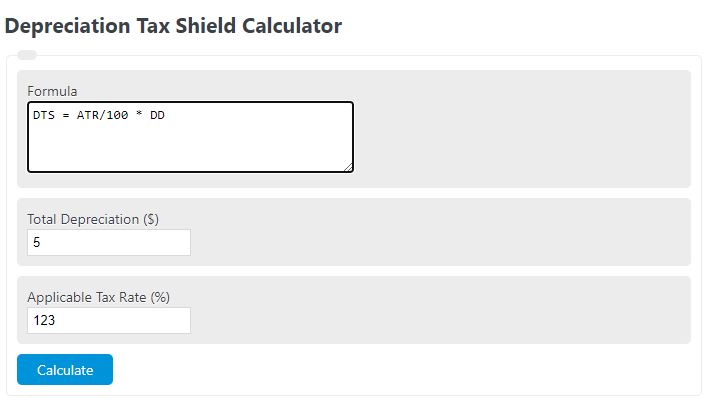

Enter the applicable tax rate and the total depreciation that can be deducted into the calculator to determine the depreciation tax shield.

- VAT Calculator

- Units of Production Depreciation Calculator

- Depreciation Calculator (% per year)

- Gross Up Paycheck Calculator

Depreciation Tax Shield Formula

The following formula is used to calculate a depreciation tax shield.

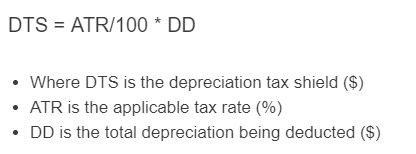

DTS = ATR/100 * DD

- Where DTS is the depreciation tax shield ($)

- ATR is the applicable tax rate (%)

- DD is the total depreciation being deducted ($)

To calculate the depreciation tax shield, divide the applicable tax rate by 100, then multiply by the total depreciation being deducted.

Depreciation Tax Shield Definition

A depreciation tax shield is defined as the amount of money that can be deducted from your taxes due to the depreciation of your assets.

Depreciation Tax Shield Example

How to calculate depreciation tax shield?

- First, determine the total depreciation amount.

Determine the total depreciation value that can be considered in the deduction. For this example, we will assume it's $100,000.00.

- Next, determine the applicable tax rate.

For this example, we will say the tax rate is 21%.

- Finally, calculate the tax shield.

Using the formula above we find the depreciation tax shield to be : 21/100 * $100,000.00 = $21,000.00.

FAQ

A depreciation tax shield is an amount of money that can be deducted from your total tax amount due to the depreciation of assets. For example, if something depreciates over time, you can deduct a percentage of the lost value.