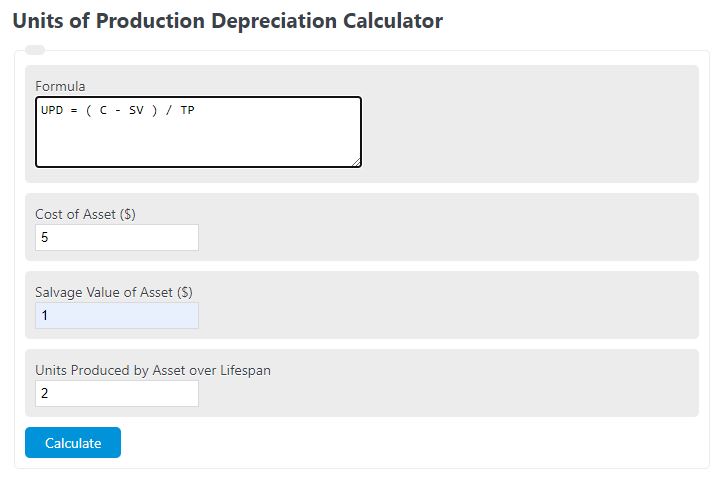

Enter the cost, salvage value, and the total estimated units produced into the calculator to determine the units of production depreciation.

Units of Production Depreciation Formula

The following formula is used to calculate the units of production depreciation.

UPD = ( C - SV ) / TP

- Where UPD is the units of production depreciation

- C is the cost basis of the asset

- SV is the salvage value of the asset

- TP is the total production of the asset over the lifespan

The cost basis of an asset refers to the original purchase price of the asset, including any additional costs such as commissions or fees.

Salvage value of an asset refers to the estimated residual value or selling price of the asset at the end of its useful life.

The term “total production of the asset over the lifespan” refers to the cumulative output or goods produced by the asset throughout its entire operational period.

Units of Production Depreciation Definition

Units of production depreciation is a method used to allocate the cost of an asset over its useful life based on the number of units it produces or the hours it operates.

This approach is commonly used for assets primarily used in production activities, such as manufacturing equipment, vehicles, or machinery.

The key idea behind units of production depreciation is that the more a productive asset is used, its value decreases over time. Instead of spreading the cost of the asset evenly over its useful life, this method assigns a higher depreciation expense during periods of high production and a lower expense during periods of low production.

The significance of units of production depreciation lies in its ability to provide a more accurate representation of an asset’s decline in value.

Unlike other depreciation methods, such as straight-line or declining balance, this approach directly associates the asset’s depreciation with its actual usage. As a result, it offers a more precise reflection of an asset’s contribution to revenue generation.

This method is particularly useful in industries where the usage of assets varies significantly throughout their lifespan.

It allows businesses to align their depreciation expenses with the actual productivity levels, promoting better matching of costs with revenues.

How to calculate units of production depreciation?

- First, determine the cost basis.

This is the total cost of the asset over its lifetime. For this example, we will say this is $100,000.00.

- Next, determine the salvage value.

Determine the total salvage value of the asset after its useful life has expired. For this example, we will say the material can be salvage for $1,000.00.

- Next, determine the units of production.

This is the total units the asset is expected to produce over its life. We will assume this value is 80 for this example.

- Finally, calculate the UPD.

We find the UPD to be ($100,000.00 – $1,000.00) / 80 = 1237.5 $/unit.

FAQ

Units of production depreciation is a measure of the expense of an asset per unit that it produces. In other words, how much cost per unit produced.