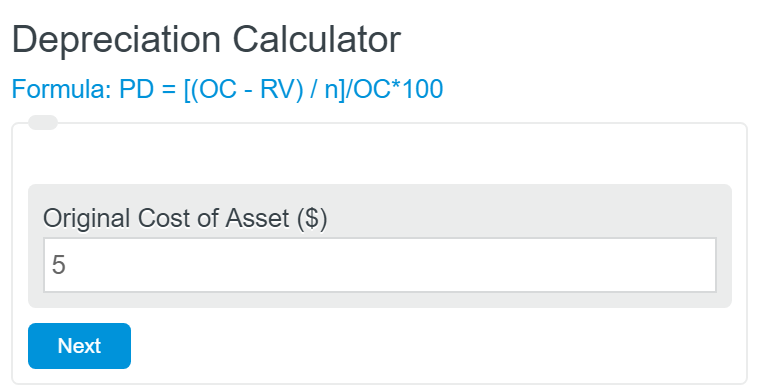

Enter the original cost, total years past, and the total residual value into the depreciation calculator to determine the % depreciation and $ depreciation per year on average.

- Double Declining Depreciation Calculator

- Depreciation Tax Shield Calculator

- Accumulated Depreciation Calculator

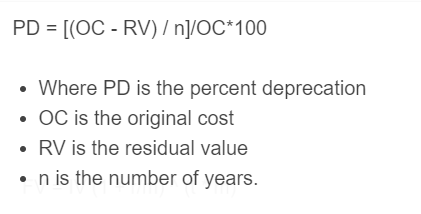

Depreciation Formula

The following formula is used to calculate the percent deprecation of an asset on a yearly basis.

PD = [(OC - RV) / n]/OC*100

- Where PD is the percent deprecation

- OC is the original cost

- RV is the residual value

- n is the number of years.

The original cost is the initial price paid for an item or asset at purchase.

Residual value refers to the estimated worth or value of an asset at the end of its useful life or lease period.

Number of years refers to the length of time measured in whole units of 365 or 366 days, typically used to indicate the age or duration of something.

Depreciation Definition

Depreciation refers to the gradual decrease in the value of an asset over time due to wear and tear, obsolescence, or other factors. It is an accounting concept used to allocate the cost of an asset over its useful life. By recognizing the reduction in value, depreciation helps businesses accurately reflect the true cost of using an asset in their financial statements.

Depreciation is important for several reasons. Firstly, it allows businesses to match the cost of an asset with the revenue it generates. Since many assets provide value over multiple years, spreading the cost through depreciation ensures that the expenses are allocated proportionally to the benefits received. This helps in determining accurate profitability and financial position. Secondly, depreciation also accounts for the wear and tear an asset experiences over time and ensures that funds are set aside for its eventual replacement or refurbishment.

This helps businesses plan and budget for future capital expenditures. Lastly, depreciation is crucial for tax purposes as it allows businesses to deduct depreciation expenses from their taxable income, reducing their tax liability. Overall, depreciation is an essential accounting method that enables businesses to accurately reflect the value and usage of their assets and make informed financial decisions.

How to calculate depreciation?

How to calculate the yearly depreciation of an asset

- Determine the initial cost

This is the initial investment or value spent on the asset.

- Determine the residual value after a certain number of years

The residual value is the worth of the asset at the current moment. The more depreciation, the less the residual value.

- Determine the number of year

Enter all of the information into the calculator or formula above.

FAQ

Depreciation is the loss of value an object or asset sees over time. This is typical of products such as cars that degrade in performance over time.

This could be for many reasons. Some cars are better and more reliable over time than others. Also, some cars turn into collectibles which causes their value to actually go up over time.

Take care of the asset as best you can. The better shape it is in when compared to the market, the more it will be worth and the less depreciation will occur.