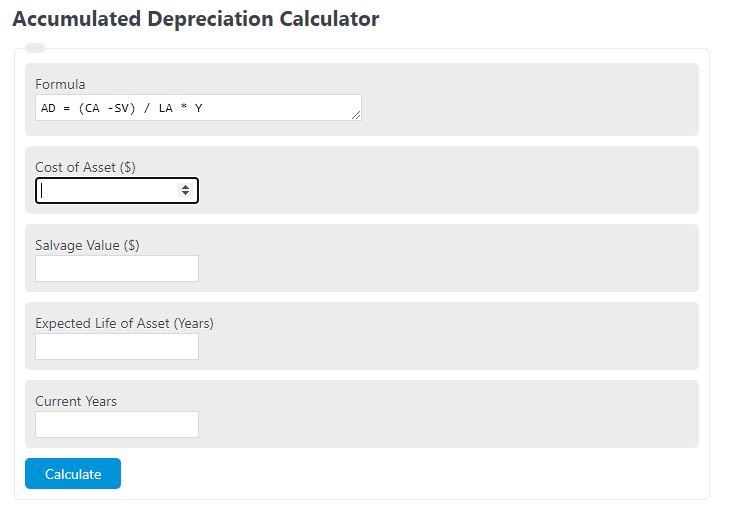

Enter the cost of the asset, salvage value, life of the asset, and the number of years owned to determine the accumulated depreciation.

- Double Declining Depreciation Calculator

- Depreciation Tax Shield Calculator

- Units of Production Depreciation Calculator

- Appliance Depreciation Calculator

- Salvage Value Calculator

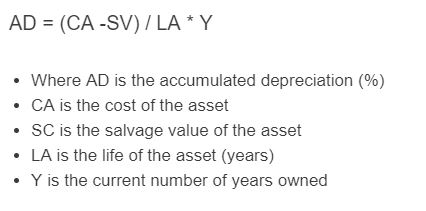

Accumulated Depreciation Formula

The following formula can be used to calculate the accumulated depreciation.

AD = (CA -SV) / LA * Y

- Where AD is the accumulated depreciation (%)

- CA is the cost of the asset

- SC is the salvage value of the asset

- LA is the life of the asset (years)

- Y is the current number of years owned

Accumulated Depreciation Definition

Accumulated Depreciation represents the total amount of depreciation expense that has been recorded for an asset since it was acquired.

Depreciation refers to the gradual decrease in the value of an asset over time due to wear and tear, obsolescence, or other factors.

As a company uses an asset, its value tends to diminish, and this decrease is recognized by recording depreciation expenses in the financial statements.

These expenses are spread over the useful life of the asset to accurately reflect its declining value and allocate its cost to the periods in which it provides value to the company.

Accumulated Depreciation is crucial because it tracks the total depreciation expense incurred over the life of an asset. It is a contra-asset account that is subtracted from the original cost of the asset to determine its net book value.

Net book value represents the remaining value of the asset after accounting for its accumulated depreciation, providing a more accurate representation of the asset's worth on the balance sheet.

Accumulated Depreciation also aids in determining the appropriate time for asset replacement or disposal.

As the depreciation expense accumulates, it provides management with an indication of when an asset is nearing the end of its useful life and may require replacement or upgrading.

Accumulated Depreciation Example

How to calculate accumulated depreciation?

- First, determine the cost of the asset.

For this example, we will say the cost of the asset was $100.00.

- Next, determine the salvage value.

For this example, the salvage value is found to be $50.00.

- Next, determine the lifetime in years.

This asset will last 10 years.

- Next, determine the number of years it's been owned.

We will say it's been owned for 2 years so far.

- Finally, calculate the accumulated depreciation.

Using the formula we find the accumulated depreciation to be (100-50)/10/*2 = $10.00.

FAQ

What factors contribute to the depreciation of an asset?

Depreciation of an asset can be influenced by wear and tear from use, obsolescence due to technological advancements, legal or market changes affecting its utility, and natural factors such as decay or environmental conditions.

How does accumulated depreciation affect a company's financial statements?

Accumulated depreciation directly impacts a company's balance sheet by reducing the book value of assets and is recorded as an expense on the income statement, which in turn reduces net income. It helps in presenting a more accurate financial health of the company by accounting for the diminishing value of its assets over time.

Can an asset's salvage value change over time, and how does it affect depreciation calculations?

Yes, an asset's salvage value can change due to market conditions or changes in how the asset is used. If the salvage value changes, it can affect future depreciation calculations by altering the annual depreciation expense, thereby impacting the accumulated depreciation and the net book value of the asset.

What happens when an asset is fully depreciated?

Once an asset is fully depreciated, it means its book value has been reduced to its salvage value, and no further depreciation expense will be recorded for that asset. However, the asset can still continue to be used by the company until it is disposed of or no longer functional.