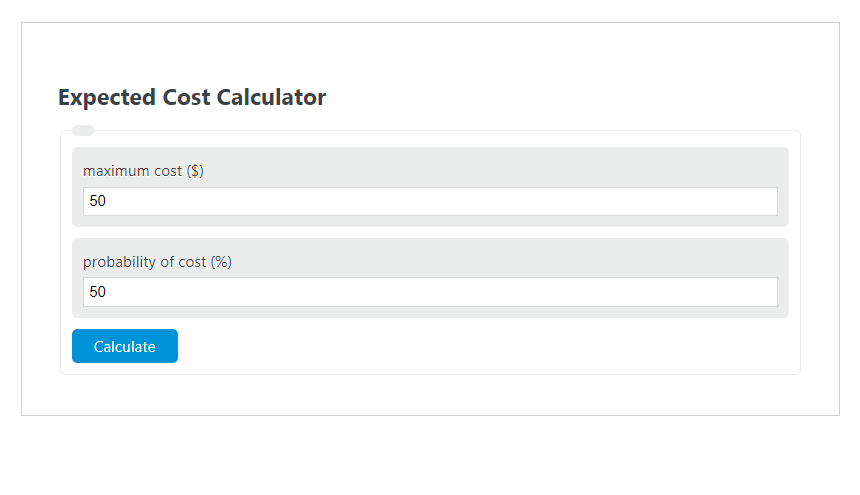

Enter the maximum cost ($) and the probability of cost (%) into the Expected Cost Calculator. The calculator will evaluate and display the Expected Cost.

- All Cost Calculators

- Distribution Cost Calculator

- Expected Value Calculator

- Expected Profit Calculator

Expected Cost Formula

The following formula is used to calculate the Expected Cost.

EC = MC * P(x)/100

- Where EC is the Expected Cost ($)

- MC is the maximum cost ($)

- P(x) is the probability of cost (%)

To calculate the expected cost multiply the maximum cost by the probability of the cost.

How to Calculate Expected Cost?

The following example problems outline how to calculate Expected Cost.

Example Problem #1:

- First, determine the maximum cost ($). The maximum cost ($) is given as 5,000.

- Next, determine the probability of cost (%). The probability of cost (%) is provided as 70.

- Finally, calculate the Expected Cost using the equation above:

EC = MC * P(x)/100

The values given above are inserted into the equation below:

EC = 5000 * .70 = 2500 ($)

FAQ

What is the importance of calculating Expected Cost in financial planning?

Calculating Expected Cost is crucial in financial planning as it helps businesses and individuals estimate the potential expenses associated with different projects or investments. This calculation allows for more informed decision-making by quantifying the financial risk and helping to set aside appropriate budgets to cover potential costs.

Can Expected Cost calculations be applied to personal finance?

Yes, Expected Cost calculations can be applied to personal finance. Individuals can use this calculation to estimate potential costs of personal projects, investments, or purchases by considering the maximum cost and the probability of incurring that cost. This can help in budgeting and saving for future expenses.

How does the probability of cost affect the Expected Cost?

The probability of cost directly influences the Expected Cost. A higher probability of incurring a cost increases the Expected Cost, reflecting a higher likelihood that the maximum cost will be realized. Conversely, a lower probability reduces the Expected Cost, indicating a lower chance of incurring the maximum cost. This relationship helps in assessing the risk level of financial decisions.