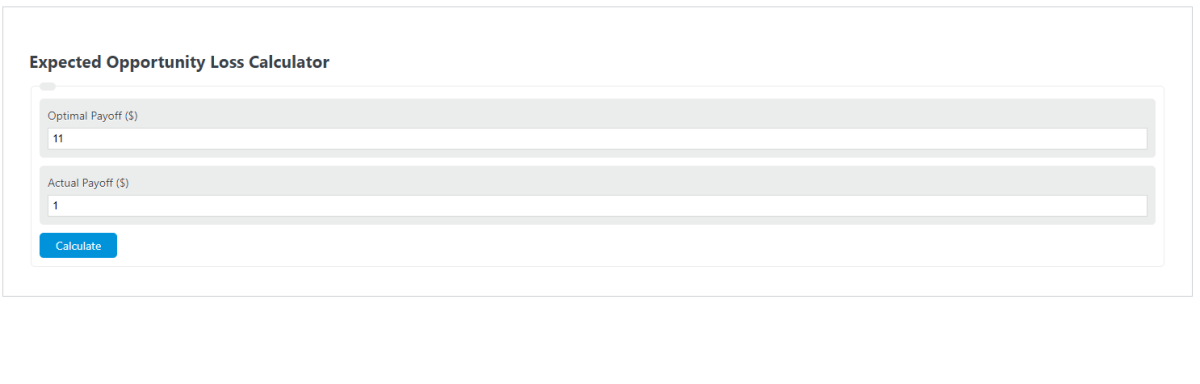

Enter the optimal payoff and the actual payoff received into the calculator to determine the expected opportunity loss. This calculator can also evaluate the optimal and actual payoff amounts if given the other variables.

- Expected Monetary Value Calculator

- Expected Value Calculator

- Expected Rate of Return Calculator

- Expected Loss Ratio Calculator

Expected Opportunity Loss Formula

The following equation is used to calculate the Expected Opportunity Loss.

EOL = OP - AP

- Where EOL is the expected opportunity loss ($)

- OP is the optimal payoff amount ($)

- AP is the actual payoff amount ($)

To calculate the expected opportunity loss, simply subtract the actual payoff amount from the optimal payoff amount.

What is an Expected Opportunity Loss?

Definition:

Expected opportunity loss is a measure of the value of an alternative foregone in order to pursue a certain investment.

For example, suppose that you have $1000 to invest, and you are considering investing it in a project that has a 10% chance of paying off $5000 and a 90% chance of paying off $0. In this scenario, your expected opportunity loss would be calculated as follows:

Expected opportunity loss = (probability of paying off * amount if profitable) – ($1000 * probability of payoff)

Expected opportunity loss = (0.1 * 5000) – ($1000 * 0.9)

Expected opportunity loss = ($500 – $1000)

This means that if you invested your money in this project, you would expect to lose $500 on average. The expected opportunity loss is the amount you would expect to lose on average if you invested your money in this way.

You should not expect to lose precisely this amount because the calculation assumes that each outcome is equally likely. In reality, some outcomes are more likely than others.