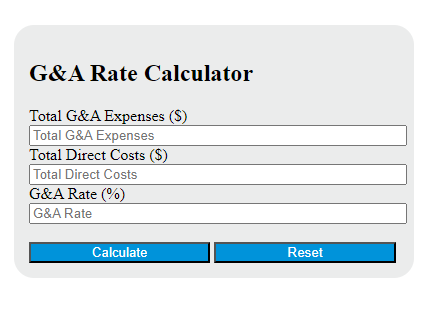

Enter the Total G&A Expenses and Total Direct Costs into the calculator to determine the G&A Rate. This calculator can also evaluate any of the variables given the others are known.

G&A Rate Formula

The following formula is used to calculate the G&A Rate.

G&A Rate = (Total G&A Expenses / Total Direct Costs) * 100Variables:

- G&A Rate is the General and Administrative expense rate (%)

- Total G&A Expenses are the total overhead costs not directly tied to the production process ($)

- Total Direct Costs are the total costs directly associated with producing a product or service ($)

To calculate the G&A Rate, divide the total G&A Expenses by the total Direct Costs. Multiply the result by 100 to convert the rate into a percentage. This will give you the proportion of indirect overhead costs in relation to the direct costs associated with producing a product or service.

What is a G&A Rate?

A G&A rate, or General and Administrative expense rate, is a financial metric used by businesses to determine the proportion of indirect overhead costs in relation to the direct costs associated with producing a product or service. These overhead costs can include salaries, utilities, rent, and other expenses necessary for the overall operation of a business but not directly tied to the production process. The G&A rate is typically expressed as a percentage and is used for budgeting, pricing, and financial analysis purposes.

How to Calculate G&A Rate?

The following steps outline how to calculate the G&A Rate.

- First, determine the Total G&A Expenses ($).

- Next, determine the Total Direct Costs ($).

- Next, use the formula G&A Rate = (Total G&A Expenses / Total Direct Costs) * 100.

- Finally, calculate the G&A Rate.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Total G&A Expenses ($) = 5000

Total Direct Costs ($) = 25000