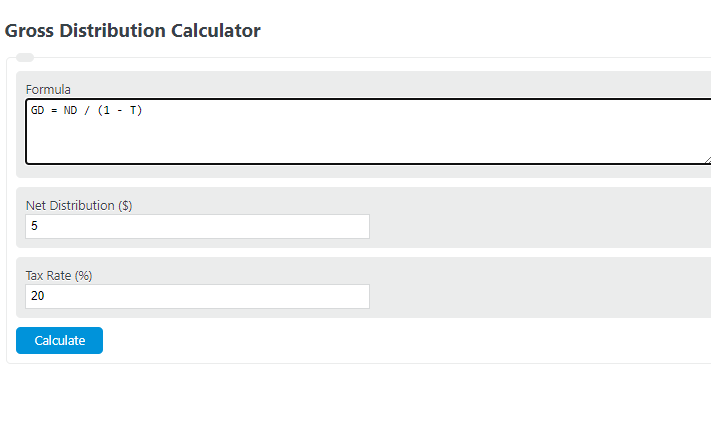

Enter the net distribution and the tax rate into the calculator to determine a gross distribution.

- Net Distribution Calculator

- ROI Calculator – Return on Investment

- Stock Calculator (Profit Calculator)

- Distribution Cost Calculator

Gross Distribution Formula

The following formula is used to calculate a gross distribution.

GD = ND / (1 - T)

- Where GD is the gross distribution

- ND is the net distribution

- T is the tax rate

To calculate the gross distribution, divide the net distribution by 1 minus the tax rate.

Gross Distribution Definition

A gross distribution is defined as the total value of distribution before taxes have been paid.

Are gross distribution taxable?

Yes, all gross distribution is subject to tax. The tax that is paid on a gross distribution depends on several factors including the total amount and the length that the distribution has been held.

Gross Distribution Example

How to calculate a gross distribution?

- First, determine the net distribution.

Calculate the net distribution that was taken home after taxes.

- Next, determine the tax rate.

Calculate or determine the total percentage tax rate.

- Finally, calculate the gross distribution.

Using the formula above, calculate the gross distribution.

FAQ

A gross distribution is a measure of the total distribution paid out to an investor before taxes have been withdrawn.