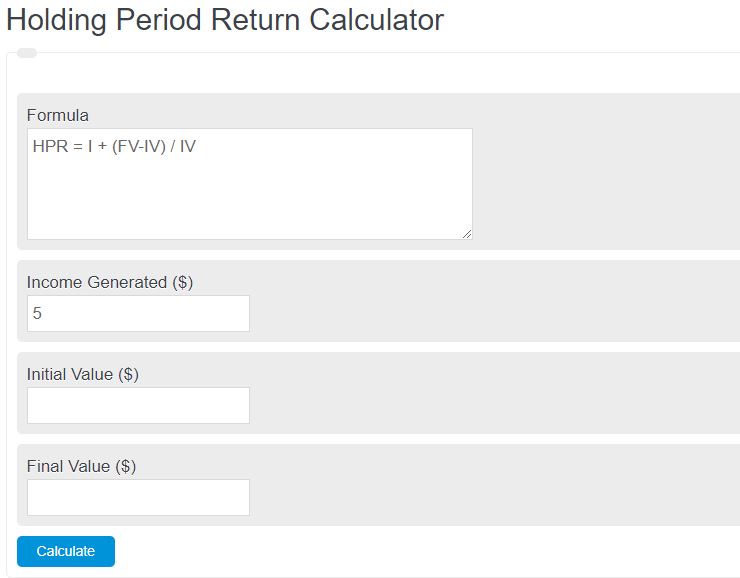

Enter the total income, initial value, and final value into the calculator. The calculator will evaluate and display the holding period return.

- ROI Calculator – Return on Investment

- Cash on Cash Return Calculator

- Return on Sales Calculator

- Total Return Calculator

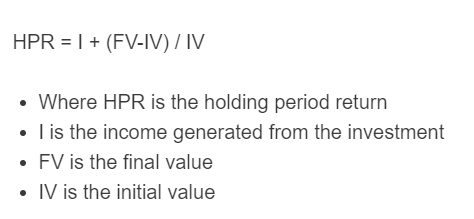

Holding Period Return Formula

The following formula is used to calculate a holding period return.

HPR = I + (FV-IV) / IV

- Where HPR is the holding period return

- I is the income generated from the investment

- FV is the final value

- IV is the initial value

Holding Period Return Definition

Holding Period Return (HPR) is a financial metric used to measure the profitability of an investment over a specific period of time. It represents the percentage gain or loss an investor has experienced during the holding period of an investment.

HPR is important because it allows investors to evaluate the performance of their investments and make informed decisions. It provides a clear understanding of the return generated during a specific period. A positive HPR indicates a profit, while a negative HPR signifies a loss.

Investors use HPR to compare different investment options and assess their profitability. It helps in determining the success of an investment strategy, identifying the most lucrative investments, and making adjustments if required. HPR also assists in evaluating the performance of investment managers or funds.

Furthermore, HPR is crucial in calculating other important financial indicators, such as the average rate of return, which measures the average gain or loss over multiple holding periods. By considering the HPR of various investments, investors can make well-informed decisions, manage their portfolios effectively, and maximize their returns.

Holding Period Return Example

How to calculate a holding period return?

- First, determine the income.

Calculate the income generated from the investment.

- Next, determine the final value.

Measure the final value of the investment.

- Next, determine the initial value.

Calculate the initial value of the investment.

- Finally, calculate the holding period return.

Use the equation above to calculate the return.

FAQ

How is the Holding Period Return (HPR) calculated?The HPR is calculated using the formula: HPR = I + (FV – IV) / IV, where I is the income generated from the investment, FV is the final value of the investment, and IV is the initial value of the investment.

Why is the Holding Period Return important for investors?The Holding Period Return is important because it allows investors to measure the profitability of an investment over a specific period, compare different investment options, assess the success of an investment strategy, and make informed decisions to maximize returns.

Can the Holding Period Return be negative?Yes, a negative Holding Period Return indicates a loss in the investment over the holding period, showing that the final value of the investment is less than the initial value plus any income generated.

How does the Holding Period Return help in evaluating investment managers or funds?The Holding Period Return helps in evaluating investment managers or funds by providing a clear metric to compare the performance of different investments over specific periods. It assists investors in determining the effectiveness of the investment strategies employed by the managers or funds.