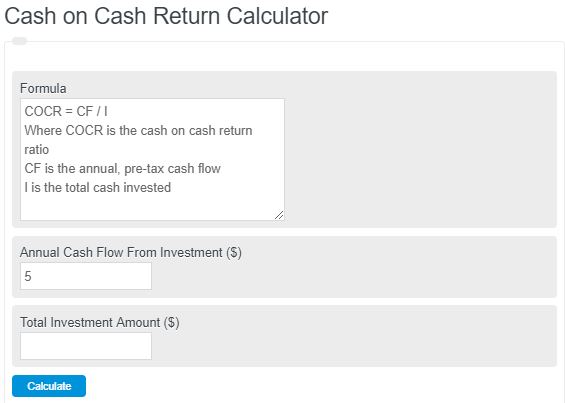

Enter the total pre-tax cash flow generated by your investment and the actual cash invested into the calculator. The calculator will display your cash-on-cash return ratio.

- Cash Coverage Ratio Calculator

- ROI Calculator

- Internal Rate of Return Calculator

- Cash Conversion Cycle Calculator

Cash on Cash Return Formula

The following formula is used to calculate the cash on cash return of an investment.

COCR = CF / I

- Where COCR is the cash-on-cash return ratio

- CF is the annual, pre-tax cash flow

- I is the total cash invested

The annual, pre-tax cash flow refers to the total amount of money generated by a business or individual before any taxes are deducted for a particular year.

Total cash invested refers to the sum of money put into a business or investment.

What is Cash-on-Cash Return?

Cash-on-Cash (CoC) is a financial metric widely used in real estate investing to evaluate the profitability and return on investment (ROI) of a property. It provides a simple and effective way to assess the cash flow generated by an investment property relative to the initial cash invested.

CoC is calculated by dividing the annual pre-tax cash flow from the property by the total cash investment and multiplying by 100 to express it as a percentage. This metric allows investors to determine how much cash they are earning on the money they have put into the property.

CoC is particularly valuable because it considers not only the property’s potential appreciation or depreciation but also the cash generated by rental income and operating expenses. By focusing on the actual cash flow, CoC provides a clearer picture of the property’s profitability.

Investors often use CoC as a benchmark to compare different investment opportunities. Higher CoC percentages indicate higher returns, while lower percentages suggest lower returns. However, it is important to note that CoC is just one aspect of evaluating an investment property, and it should be considered alongside other factors such as property appreciation potential, market conditions, and risk tolerance.

Cash on Cash Return Example

How to calculate cash on cash return

- First, determine the total amount invested

This is the total cash invested in the asset.

- Next, determine the annual pre-tax cash flow

This is the total income/cash flow your new investment is generating on a yearly basis.

- Finally, calculate the COCR

Calculate the cash on cash return of your investment using the equation above and the information from steps 1 and 2.

FAQ

Cash on cash return is a measure of the annual cash earned from an investment with respect to the total amount of money invested.

In general, a 20% yearly cash on cash return is solid cash on cash return. In short, this means the investment will pay for itself in 5 years. The greater the return, the quicker the payoff.