Enter an initial investment and the cash flow generated from that investment in each of the following years (up to 5 years) to calculate the internal rate of return.

- Return on Equity Calculator

- Maximum Revenue Calculator

- Growth Rate Calculator

- ROI Calculator – Return on Investment

Internal Rate of Return Formula

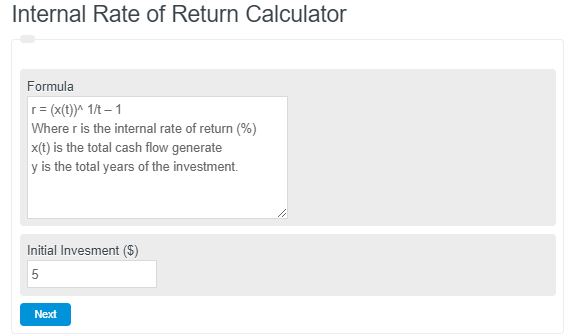

The following formula is used by the calculator above to calculate the internal rate of return of an investment.

r = (x(t) – x0)^ 1/y– 1

- Where r is the internal rate of return (%)

- x(t) – x0 is the final value - the initial investment

- y is the total years of the investment.

It's important to note that the total final value is equal to the initial investment plus the cash flow each year. This means that this equation can further be simplified into the following:

r = (x(t))^ 1/t – 1

- Where X(t) is the total cash flow generated by the investment.

Internal Rate of Return Definition

The Internal Rate of Return (IRR) is a financial metric used to assess the profitability of an investment. It represents the discount rate that makes the net present value (NPV) of the investment equal to zero. In other words, it is the rate at which the present value of cash inflows equals the present value of cash outflows.

IRR is crucial because it allows investors to evaluate the potential profitability of an investment project.

FAQ

What is the difference between IRR and ROI?

IRR (Internal Rate of Return) is a financial metric that calculates the rate of return at which the net present value of all cash flows (both positive and negative) from a project or investment equals zero. ROI (Return on Investment), on the other hand, measures the efficiency of an investment by comparing the net profit of the investment to its initial cost.

How does the time value of money affect the calculation of IRR?

The time value of money is a core principle in finance that suggests money available now is worth more than the same amount in the future due to its potential earning capacity. This principle is crucial in calculating IRR because it involves discounting future cash flows to their present value to determine the rate at which the net present value of these cash flows equals zero.

Can IRR be used for investments with irregular cash flows?

Yes, IRR can be used for investments with irregular cash flows. The IRR calculation does not assume constant annual cash flows, making it suitable for analyzing investments where cash inflows and outflows vary over time.

Why might an investment with a high IRR not always be the best choice?

While a high IRR indicates a potentially attractive investment, it may not always be the best choice due to several factors. These can include risk level, the scale of investment, liquidity concerns, or the time horizon of the investment. Additionally, projects with high IRRs may also involve higher levels of uncertainty or require a longer period to realize the returns, making them less desirable compared to investments with lower, but more certain returns.