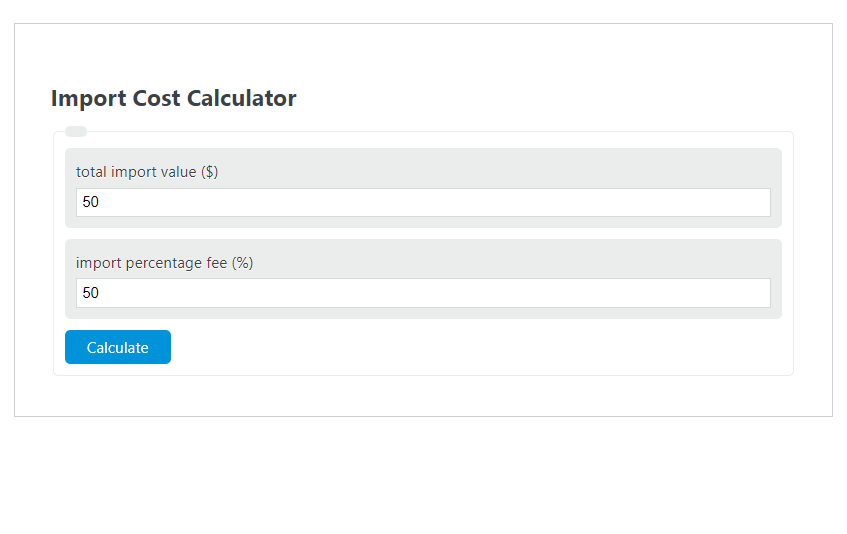

Enter the total import value ($) and the import percentage fee (%) into the Import Cost Calculator. The calculator will evaluate and display the Import Cost.

Import Cost Formula

The following formula is used to calculate the Import Cost.

IC = IV * IF/100

- Where IC is the Import Cost ($)

- IV is the total import value ($)

- IF is the import percentage fee (%)

To calculate the import cost, multiply the import value by the import fee rate.

How to Calculate Import Cost?

The following example problems outline how to calculate Import Cost.

Example Problem #1:

- First, determine the total import value ($). The total import value ($) is given as 45,000.

- Next, determine the import percentage fee (%). The import percentage fee (%) is provided as 5.

- Finally, calculate the Import Cost using the equation above:

IC = IV * IF/100

The values given above are inserted into the equation below:

IC = 45,000 * 5/100 = 2250.00 ($)

FAQ

What factors can influence the import percentage fee?

The import percentage fee can vary based on several factors including the type of goods being imported, the country of origin, trade agreements between the exporting and importing countries, and specific government policies or tariffs. It’s important to check the latest regulations and fees applicable for your specific import scenario.

How can fluctuations in currency exchange rates affect import costs?

Fluctuations in currency exchange rates can significantly affect the total import value and, consequently, the import cost. If the currency of the importing country weakens against the exporting country’s currency, the cost of importing goods will increase, and vice versa. Importers should monitor exchange rates closely and consider financial instruments like forward contracts to hedge against unfavorable movements.

Are there any additional costs that should be considered beyond the calculated import cost?

Yes, the calculated import cost typically covers the cost of the goods and the import fee. However, importers should also account for additional costs such as shipping and handling, insurance, taxes (such as VAT or GST), and any customs brokerage fees. These costs can add significantly to the total landed cost of the imported goods.