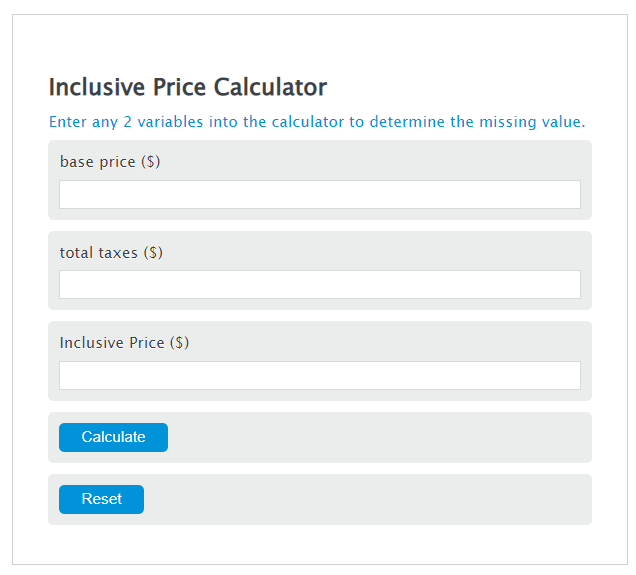

Enter the base price ($) and the total taxes ($) into the Calculator. The calculator will evaluate the Inclusive Price.

Inclusive Price Formula

IP = BP + T

Variables:

- IP is the Inclusive Price ($)

- BP is the base price ($)

- T is the total taxes ($)

To calculate the Inclusive Price, add the base price and the total tax cost together.

How to Calculate Inclusive Price?

The following steps outline how to calculate the Inclusive Price.

- First, determine the base price ($).

- Next, determine the total taxes ($).

- Next, gather the formula from above = IP = BP + T.

- Finally, calculate the Inclusive Price.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

base price ($) = 750

total taxes ($) = 230

Frequently Asked Questions (FAQ)

What is the difference between inclusive and exclusive pricing?

Inclusive pricing includes all taxes and fees in the final price shown to customers, while exclusive pricing shows these costs separately from the advertised price.

How can calculating the inclusive price help consumers?

Calculating the inclusive price helps consumers understand the total cost they will pay, making it easier to compare prices and budget accordingly.

Are there any tools available to help calculate taxes for different products or services?

Yes, there are various online calculators and software tools designed to help calculate taxes based on the type of product or service and the applicable tax rates in different regions.

Can the inclusive price formula be used for services as well as products?

Yes, the inclusive price formula can be applied to both products and services to determine the total cost including taxes.