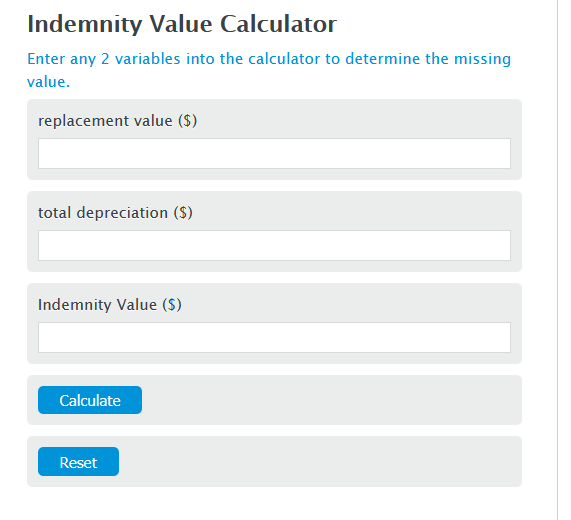

Enter the replacement value ($) and the total depreciation ($) into the Calculator. The calculator will evaluate the Indemnity Value.

Indemnity Value Formula

IV = RV - D

Variables:

- IV is the Indemnity Value ($)

- RV is the replacement value ($)

- D is the total depreciation ($)

To calculate Indemnity Value, subtract the total depreciation from the replacement value.

How to Calculate Indemnity Value?

The following steps outline how to calculate the Indemnity Value.

- First, determine the replacement value ($).

- Next, determine the total depreciation ($).

- Next, gather the formula from above = IV = RV – D.

- Finally, calculate the Indemnity Value.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

replacement value ($) = 3000

total depreciation ($) = 2000

FAQs

What is the significance of calculating Indemnity Value?

Calculating Indemnity Value is crucial for understanding the actual financial loss or the net value of an asset after accounting for depreciation. This is particularly important in insurance claims and asset valuation for businesses or individuals.

How does depreciation affect Indemnity Value?

Depreciation reduces the overall value of an asset over time due to wear and tear, usage, or obsolescence. The higher the total depreciation, the lower the Indemnity Value, reflecting the decreased worth of the asset.

Can Indemnity Value be negative?

Technically, Indemnity Value should not be negative because it represents the remaining value of an asset after depreciation. However, if a calculation results in a negative number, it may indicate an error or that the asset’s depreciation exceeds its original replacement value.

Is it possible to increase the Indemnity Value of an asset?

Yes, the Indemnity Value of an asset can be increased by reducing the rate of depreciation. This can be achieved through regular maintenance, upgrades, or limiting the usage of the asset to preserve its condition and extend its useful life.