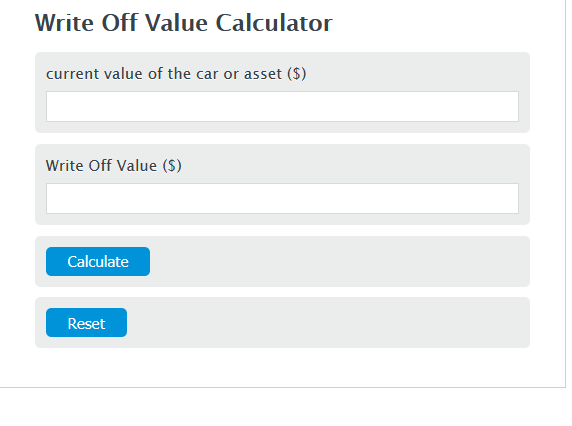

Enter the current value of the car or asset ($) into the Calculator. The calculator will evaluate the Write Off Value.

Write Off Value Formula

WOV = .50 * CV

Variables:

- WOV is the Write Off Value ($)

- CV is the current value of the car or asset ($)

To calculate Write Off Value, multiply the current value of the asset by 50%.

How to Calculate Write-Off Value?

The following steps outline how to calculate the Write Off Value.

- First, determine the current value of the car or asset ($).

- Next, gather the formula from above = WOV = .50 * CV.

- Finally, calculate the Write Off Value.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

current value of the car or asset ($) = 25000

FAQ

What is a write-off value?

The write-off value is the amount that can be deducted from the total value of an asset, typically in the context of tax or accounting, representing depreciation or the reduction in value due to use, damage, or obsolescence.

Why is calculating the write-off value important?

Calculating the write-off value is important for financial reporting and tax purposes. It helps in determining the actual worth of an asset over time and in making informed decisions regarding the disposal, replacement, or continued use of the asset.

Can the write-off value be different based on the method of calculation?

Yes, the write-off value can vary depending on the method of calculation used. Different accounting practices, such as straight-line depreciation or reducing balance method, can result in different write-off values for the same asset over time.

How often should the write-off value be calculated?

The frequency of calculating the write-off value depends on the asset type and the accounting practices of the organization. Typically, it is calculated annually for financial reporting purposes, but it may be reviewed more frequently for internal decision-making processes.