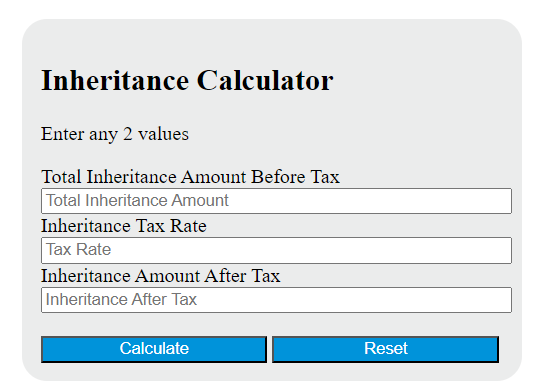

Enter the total inheritance amount before tax and the inheritance tax rate into the calculator to determine the inheritance amount after tax. This calculator can also evaluate any of the variables given the others are known.

Inheritance Formula

The following formula is used to calculate the inheritance amount after tax.

I = (T - (T * r))

Variables:

- I is the inheritance amount after tax

- T is the total inheritance amount before tax

- r is the inheritance tax rate

To calculate the inheritance amount after tax, subtract the product of the total inheritance amount before tax and the inheritance tax rate from the total inheritance amount before tax.

What is an Inheritance?

Inheritance is a fundamental concept in object-oriented programming where a new class is derived from an existing class. The new class, known as the derived class or subclass, inherits the attributes and behaviors (methods) of the existing class, known as the base class or superclass. This allows for code reusability and the ability to add new features to existing code without modifying it. The derived class can also override or extend the properties and methods of the base class.

How to Calculate Inheritance?

The following steps outline how to calculate the Inheritance amount after tax using the given formula:

- First, determine the total inheritance amount before tax (T).

- Next, determine the inheritance tax rate (r).

- Next, use the formula I = (T – (T * r)) to calculate the inheritance amount after tax (I).

- Finally, calculate the Inheritance amount after tax.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Total inheritance amount before tax (T) = $500,000

Inheritance tax rate (r) = 0.25