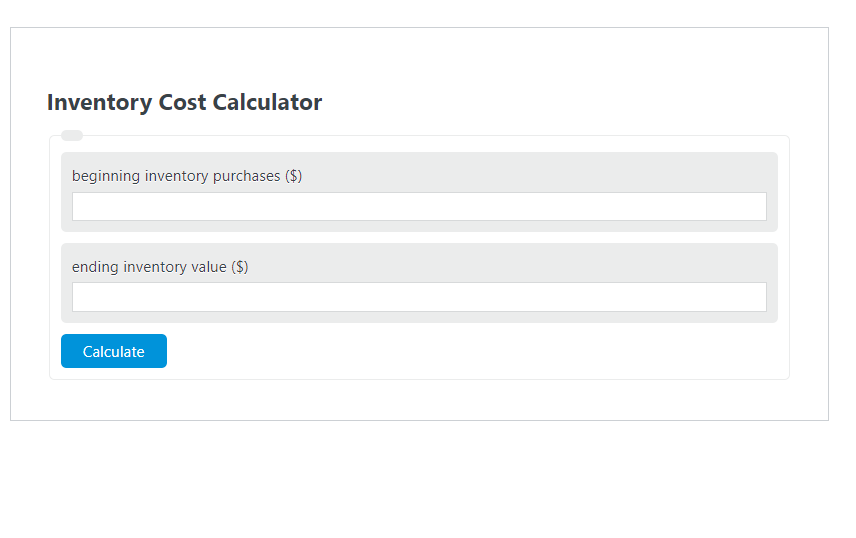

Enter the beginning inventory purchases ($) and the ending inventory value ($) into the Inventory Cost Calculator. The calculator will evaluate and display the Inventory Cost.

- All Cost Calculators

- Inventory Turnover Ratio Calculator

- Percentage of Cost Calculator

- Ending Inventory Calculator

Inventory Cost Formula

The following formula is used to calculate the Inventory Cost.

IC = BIP - EIV

- Where IC is the Inventory Cost ($)

- BIP is the beginning inventory purchases ($)

- EIV is the ending inventory value ($)

To calculate the inventory cost, subtract the engine inventory value from the beginning inventory purchases.

How to Calculate Inventory Cost?

The following example problems outline how to calculate Inventory Cost.

Example Problem #1:

- First, determine the beginning inventory purchases ($). The beginning inventory purchases ($) is given as 500.

- Next, determine the ending inventory value ($). The ending inventory value ($) is provided as 300.

- Finally, calculate the Inventory Cost using the equation above:

IC = BIP – EIV

The values given above are inserted into the equation below:

IC = 500 – 300 = 200 ($)

FAQ

What is the significance of calculating Inventory Cost?

Calculating Inventory Cost is crucial for businesses as it helps in understanding the cost associated with the inventory during a specific period. This calculation aids in financial planning, budgeting, and assessing the overall efficiency of inventory management. It also impacts the gross profit margin, making it a vital metric for financial analysis and decision-making.

How can inaccuracies in inventory valuation affect a business?

Inaccuracies in inventory valuation can lead to significant financial implications for a business. Overvaluation of inventory can result in overstated assets and profits, potentially leading to incorrect financial reporting and tax issues. Conversely, undervaluation of inventory can result in understated profits, which might affect a company’s investment attractiveness and creditworthiness. Accurate inventory valuation is essential for reliable financial statements and operational efficiency.

Are there any other methods to calculate inventory cost besides the formula provided?

Yes, besides the basic formula of subtracting ending inventory value from beginning inventory purchases, there are other methods to calculate inventory cost, including the First-In, First-Out (FIFO), Last-In, First-Out (LIFO), and Average Cost methods. Each method has its advantages and is chosen based on the business model, the nature of the inventory, and regulatory requirements. These methods can significantly affect the reported inventory cost and financial outcomes.