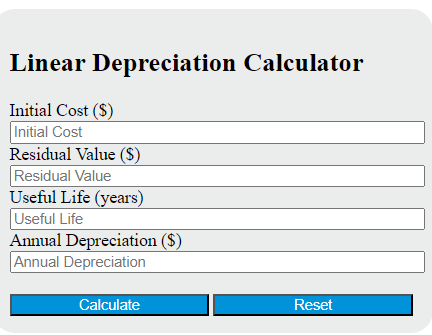

Enter the initial cost of the asset, the residual value of the asset at the end of its useful life, and the useful life of the asset into the calculator to determine the annual depreciation expense.

- Recapture Depreciation Calculator

- Reverse Depreciation Calculator

- Units of Production Depreciation Calculator

Linear Depreciation Formula

The following formula is used to calculate the linear depreciation.

D = (C - R) / N

Variables:

- D is the annual depreciation expense ($)

- C is the initial cost of the asset ($)

- R is the residual value of the asset at the end of its useful life ($)

- N is the useful life of the asset (in years)

To calculate the annual depreciation expense, subtract the residual value of the asset at the end of its useful life from the initial cost of the asset. Then, divide the result by the useful life of the asset in years.

What is a Linear Depreciation?

Linear depreciation is a method of allocating the cost of a tangible asset over its useful life in a straight-line manner. It assumes the asset will decrease in value at a constant rate over its life. This is the most commonly used method of depreciation due to its simplicity. The depreciation expense is the same for each year of the asset’s life.

How to Calculate Linear Depreciation?

The following steps outline how to calculate the Linear Depreciation.

- First, determine the initial cost of the asset ($), denoted as C.

- Next, determine the residual value of the asset at the end of its useful life ($), denoted as R.

- Next, determine the useful life of the asset (in years), denoted as N.

- Next, gather the formula from above = D = (C – R) / N.

- Finally, calculate the Linear Depreciation.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

initial cost of the asset ($) = 5000

residual value of the asset at the end of its useful life ($) = 1000

useful life of the asset (in years) = 10