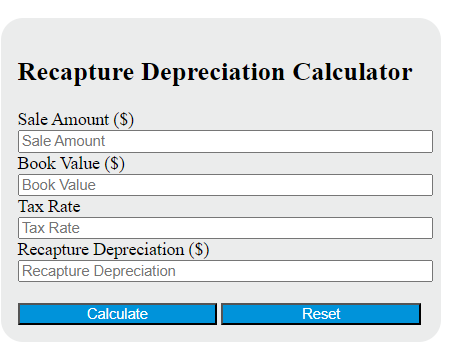

Enter the sale amount of the asset, the book value of the asset at the time of sale, and the tax rate into the calculator to determine the recapture depreciation. This calculator can also evaluate any of the variables given the others are known.

Recapture Depreciation Formula

The following formula is used to calculate the recapture depreciation.

RD = (SA - BA) * TR

Variables:

- RD is the recapture depreciation ($)

- SA is the sale amount of the asset ($)

- BA is the book value of the asset at the time of sale ($)

- TR is the tax rate (decimal)

To calculate the recapture depreciation, subtract the book value of the asset at the time of sale from the sale amount of the asset. Then, multiply the result by the tax rate.

What is a Recapture Depreciation?

Recapture depreciation is a tax provision that allows the IRS to collect taxes on any profitable sale of an asset that the taxpayer had previously used to offset his or her taxable income. Essentially, it is the gain realized on the sale of a depreciable capital property that must be reported as income for tax purposes. Recapture depreciation is meant to prevent taxpayers from receiving a double benefit from depreciation.

How to Calculate Recapture Depreciation?

The following steps outline how to calculate the Recapture Depreciation.

- First, determine the sale amount of the asset ($).

- Next, determine the book value of the asset at the time of sale ($).

- Next, gather the formula from above = RD = (SA – BA) * TR.

- Finally, calculate the Recapture Depreciation.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

sale amount of the asset ($) = 5000

book value of the asset at the time of sale ($) = 3000

tax rate (decimal) = 0.25