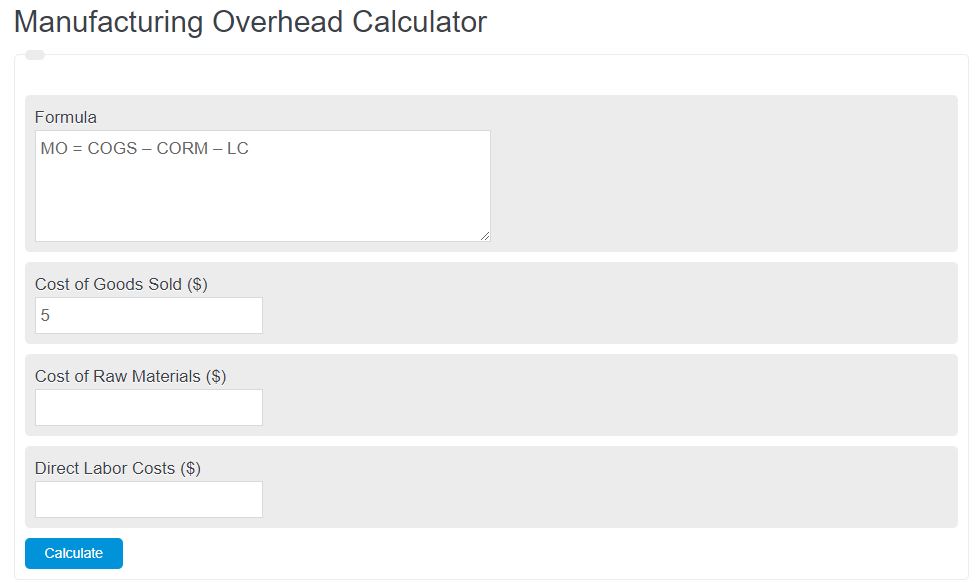

Enter the total cost of goods sold, cost of raw materials, and direct labor costs. The calculator will evaluate and display the manufacturing overhead.

- Cost of Goods Manufactured Calculator (COGM)

- Efficiency Ratio Calculator

- Marginal Product of Labor Calculator

- Total Manufacturing Cost Calculator

- Manufacturing Cycle Efficiency Calculator

Manufacturing Overhead Formula

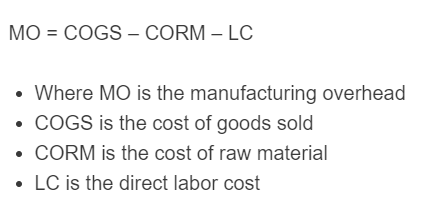

The following equation is used to calculate the manufacturing overhead of an item.

MO = COGS – CORM – LC

- Where MO is the manufacturing overhead

- COGS is the cost of goods sold

- CORM is the cost of raw material

- LC is the direct labor cost

To calculate manufacturing overhead, subtract the cost of raw material from the cost of goods sold, then subtract the direct labor cost.

Manufacturing Overhead Definition

Manufacturing overhead is a term used in business to describe the total revenue a manufactured good earns minus its raw material cost and direct labor lost. This does not include indirect labor costs or machinery costs.

Manufacturing Overhead Example

How to calculate manufacturing overhead?

- First, determine the COGS.

Calculate the direct cost of goods sold.

- Next, determine the cost of raw material.

Calculate the cost of raw material.

- Next, determine the direct labor costs.

Calculate the direct labor costs associated with the good.

- Finally, calculate the manufacturing overhead.

Calculate the manufacturing overhead using the equation above.

FAQ

Manufacturing overhead is considered the extra cost of manufacturing a good that isn’t included in direct labor or material costs. That could mean managerial costs, equipment cost, etc.