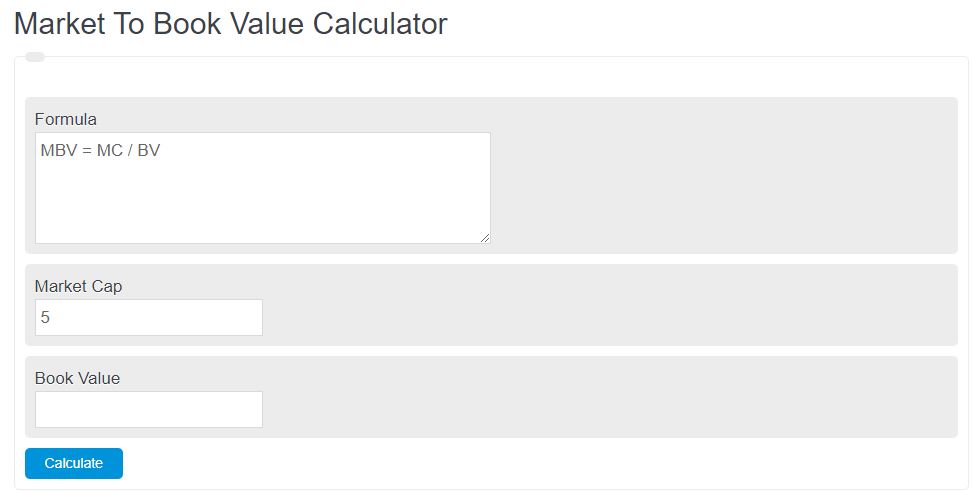

Enter the total market capitalization and the total book value. The calculator will evaluate and display the market to book value.

- Market Capitalization Calculator

- Book Value Per Share Calculator

- Equity Value Calculator

- Net Asset Value Calculator

- Estimated Recovery Value (ERV) Calculator

Market to Book Value Formula

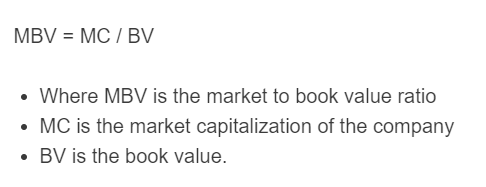

The following equation is used to calculate a market-to-book value ratio.

MBV = MC / BV

- Where MBV is the market-to-book value ratio

- MC is the market capitalization of the company

- BV is the book value.

What is a Market-to-Book Value Ratio?

Market-to-Book Value Ratio (M/B) is a financial metric used to assess the relationship between a company’s market value and its book value.

The market value represents the current market price of a company’s shares. In contrast, the book value represents the net value of a company’s assets, calculated by subtracting liabilities from total assets.

This ratio is important as it provides insights into how the market perceives a company’s worth of its accounting value.

A high M/B ratio indicates that investors value the company more highly than its book value, suggesting positive market sentiment and potential future growth.

A low M/B ratio suggests that the company is undervalued or facing challenges, potentially indicating an investment opportunity.

The M/B ratio is particularly relevant for investors and analysts as it helps in evaluating a company’s financial performance and making investment decisions.

It allows investors to compare a company’s market value to its book value, indicating whether the stock is overpriced or underpriced. By comparing the M/B ratio of a company to its industry peers or the overall market, investors can identify potential investment opportunities or market trends.

Market to Book Value Example

How to calculate market-to-book value?

- First, determine the market cap.

Calculate the total market capitalization of the company.

- Next, determine the book value.

Calculate the total book value of the stock.

- Finally, calculate the market-to-book value.

Use the equation above to calculate the market-to-book value.

FAQ

Why is the market-to-book value ratio important for investors?

The market-to-book value ratio is crucial for investors as it helps them assess whether a company’s stock is overpriced or underpriced compared to its actual net assets. It provides insights into how the market values the company relative to its book value, which can indicate potential investment opportunities or risks.

How can a high market-to-book value ratio be interpreted?

A high market-to-book value ratio suggests that the market values the company more highly than its book value. This can indicate positive market sentiment, expectations of future growth, or that the company has intangible assets and goodwill not reflected in the book value. However, it might also suggest that the stock is overvalued.

What does a low market-to-book value ratio indicate?

A low market-to-book value ratio indicates that the market values the company less than its book value. This could suggest that the company is undervalued or facing challenges that have led to negative market sentiment. It might represent a potential investment opportunity, assuming the underlying reasons for the low ratio do not pose significant risks.

Can the market-to-book value ratio vary by industry?

Yes, the market-to-book value ratio can vary significantly across different industries. Industries with high levels of intangible assets, such as technology or pharmaceuticals, may have higher ratios due to the value of patents, intellectual property, and goodwill. Conversely, more tangible asset-heavy industries, like manufacturing or utilities, may have lower ratios. Comparing companies within the same industry can provide more meaningful insights.