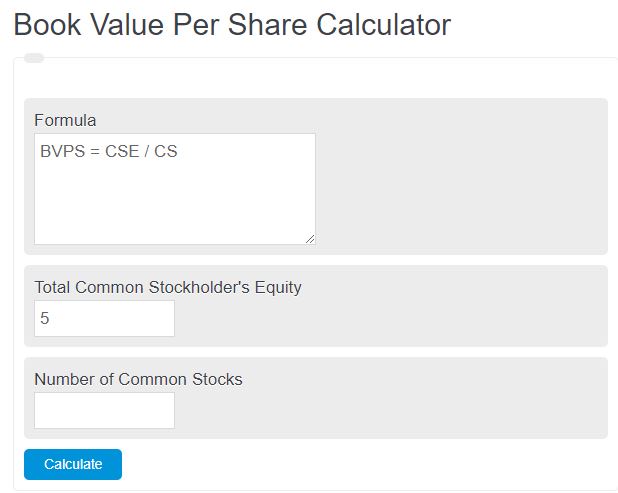

Enter the total common stockholder’s equity and the total number of common shares into the calculator. The calculator will evaluate and display the total book value per share.

- Actual Cash Value Calculator

- Earnings Per Share Calculator

- Stock Calculator (Profit Calculator)

- Market to Book Value Calculator

- RSI (Relative Strength Index) Calculator

- Graham Number Calculator

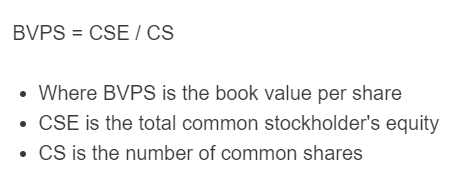

Book Value Per Share Formula

The following formula is used to calculate the book value per share.

BVPS = CSE / CS

- Where BVPS is the book value per share

- CSE is the total common stockholder’s equity

- CS is the number of common shares

Book Value Per Share Definition

Book Value Per Share is a financial metric that calculates the value of a company’s equity per outstanding share of common stock. It is obtained by dividing the total shareholder’s equity by the number of shares outstanding. This metric provides insight into the net worth of a company on a per-share basis.

By analyzing the Book Value Per Share, investors can assess the financial health and stability of a company.

It represents the accounting value of the company’s assets after deducting liabilities and measures its net worth. A higher Book Value Per Share generally indicates a stronger financial position, which signifies that the company’s assets exceed its debts.

Investors often compare the Book Value Per Share to the market price of the stock to determine whether it is undervalued or overvalued.

If the market price is below the Book Value Per Share, it suggests that the stock may be undervalued, potentially presenting a buying opportunity.

If the market price is significantly higher than the Book Value Per Share, it may indicate an overvalued stock, which could be a signal to sell.

Book Value Per Share Example

How to calculate a book value per share?

- First, determine the total common stockholder’s equity.

Calculate the common stockholder’s total equity.

- Next, determine the number of common shares.

Calculate the total number of common shares.

- Finally, calculate the book value per share.

Calculate the book value per share using the formula above.

FAQ

What factors can affect the book value per share of a company?

The book value per share can be influenced by several factors including changes in the company’s total equity, issuance or repurchase of shares, and adjustments in asset or liability valuations. Significant corporate actions like mergers, acquisitions, or restructuring can also have an impact.

How is book value per share different from market value per share?

Book value per share represents the accounting value of a company’s equity divided by its number of shares, reflecting the net asset value. Market value per share, on the other hand, is determined by the stock market through supply and demand dynamics, often reflecting investors’ perceptions and future growth expectations rather than just the net asset value.

Can a negative book value per share indicate financial trouble for a company?

Yes, a negative book value per share indicates that a company’s liabilities exceed its assets, which may suggest financial distress. However, it’s important to analyze other financial metrics and the context of the company’s industry before drawing conclusions about its financial health.

Why might investors compare book value per share to market price?

Investors often compare the book value per share to the market price to identify potentially undervalued or overvalued stocks. If the market price is significantly below the book value per share, it may suggest that the stock is undervalued, presenting a buying opportunity. Conversely, if the market price is much higher, it might indicate that the stock is overvalued.