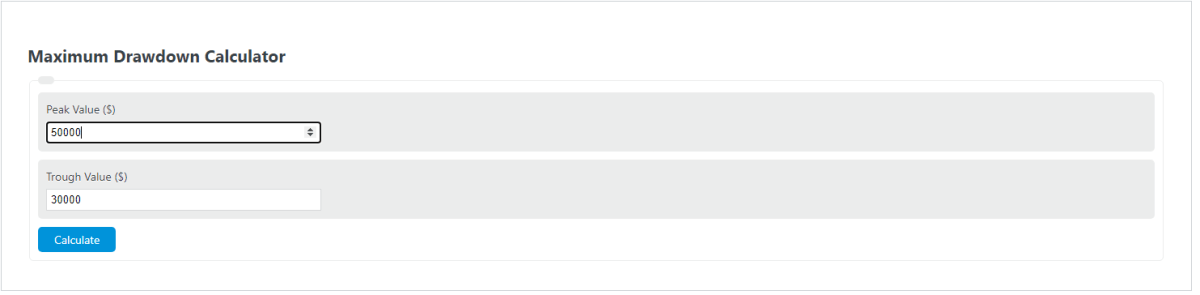

Enter the peak value and trough value of a portfolio into the calculator to determine the maximum drawdown.

- Beta Portfolio Calculator

- MACD Calculator

- RSI (Relative Strength Index) Calculator

- CAPM Beta Calculator

Maximum Drawdown Formula

The following formula is used to calculate a maximum drawdown.

MD = (TV - PV) / PV *100

- Where MD is the maximum drawdown (%)

- TV is the trough value ($)

- PV is the peak value ($)

Maximum Drawdown Definition

Maximum Drawdown refers to the largest decline in the value of an investment or trading account from its peak value to its lowest point. It measures the extent of loss that an investment has experienced during a specific period.

Instead of focusing on the magnitude of gains, Maximum Drawdown assesses the risk and potential losses associated with an investment.

Investors and traders closely monitor Maximum Drawdown as it provides a crucial insight into the downside risk and volatility of an investment.

By analyzing the maximum decline, they can evaluate the potential loss they might face during adverse market conditions. This metric enables them to assess the level of risk they are comfortable with and make informed decisions about their investments.

Maximum Drawdown is particularly important because it helps investors understand the resilience and stability of an investment or trading strategy. It reveals the worst-case scenario regarding potential losses, allowing investors to prepare for potential downturns and adjust their investment strategies accordingly.

By considering the Maximum Drawdown, investors can set realistic expectations and align their risk tolerance with the potential losses they might incur.

Example Problem

How to calculate a maximum drawdown?

- First, determine the peak value.

For this example, a portfolio goes through a series of ups and downs during a 2-year long period. During that period, the maximum peak value it reaches is $500,000.

- Next, determine the trough value.

Over the same 2-year period, this portfolio reached a trough of $300,000.00.

- Finally, calculate the maximum drawdown of this portfolio.

Using the formula above, the maximum drawdown is calculated to be:

MD = (TV – PV) / PV *100

MD = (300,000 – 500,000) / 500,000 *100

MD = -40%

FAQ

What is the significance of calculating the Maximum Drawdown of a portfolio?

The Maximum Drawdown provides vital information about the risk and potential losses associated with an investment. It helps investors understand the worst-case scenario for potential losses, allowing them to assess their risk tolerance and make informed investment decisions.

Can Maximum Drawdown be used to compare different investments?

Yes, Maximum Drawdown can be a useful metric for comparing the risk and stability of different investments. By evaluating the Maximum Drawdown, investors can compare how different investments might perform under adverse market conditions, helping them choose investments that align with their risk tolerance.

How does Maximum Drawdown differ from other risk assessment tools?

Unlike other risk assessment tools that might focus on the volatility or the expected return of an investment, Maximum Drawdown specifically measures the largest single drop from peak to trough. This provides a clear picture of the potential loss an investment can face, making it a unique tool for assessing the downside risk.

Is it better to have a higher or lower Maximum Drawdown?

A lower Maximum Drawdown is generally preferable as it indicates that the investment has experienced smaller declines from its peak value, suggesting lower risk and potentially more stability. However, the acceptability of a Maximum Drawdown level depends on an investor’s risk tolerance and investment strategy.