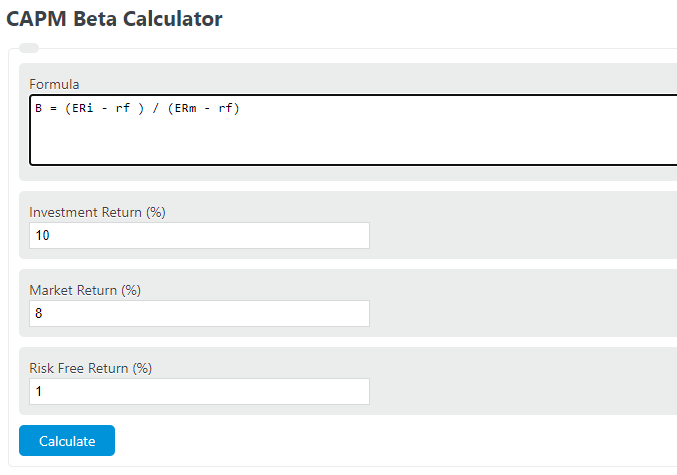

Enter the expected return from your investment, the expected return of the market, and risk-free return to determine the CAPM beta.

- CAPM (Capital Asset Pricing Model) Calculator

- Risk Premium Calculator

- Levered Beta Calculator

- Expected Rate of Return Calculator

CAPM Beta Formula

The following formula is used to calculate a CAPM beta.

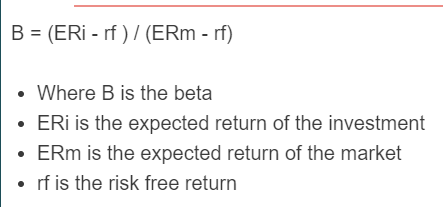

B = (ERi - rf ) / (ERm - rf)

- Where B is the beta

- ERi is the expected return of the investment

- ERm is the expected return of the market

- rf is the risk-free return

To calculate a CAPM beta, subtract the expected market return from the expected investment return, then divide by the result of the market return minus the risk-free return.

CAPM Beta Definition

A CAPM beta is a coefficient used in the capital asset pricing model to describe the ratio of the return of an investment compared to the return of the market relative to a risk-free investment.

Can CAPM Beta be negative?

CAPM beta can be negative if the expected return of the investment or expected return of the market is less than the risk-free return. In reality, this almost never happens unless you have a poor investment, but it is entirely possible.

What does beta mean in CAPM?

Beta in CAPM is a measure of how good your investment is performing compared to the market, but relative to some risk-free asset. The higher the beta the better performing your asset is, or the worse performing the overall market is compared to your investment.

What is zero beta CAPM?

A zero beta CAPM is a model in which the return on investment is equal to that of a risk-free return. This results in a beta of zero.

Is CAPM beta levered or unlevered?

More often than not, CAPM beta is considered to be unlevered.

CAPM Beta Example

How to calculate CAPM beta?

- First, determine the return of your investment.

Estimate the expected return of your investment.

- Next, determine the return of the market.

Estimate the return of the market over the same time period.

- Next, determine the return of a risk free asset.

This is typically assets like bonds.

- Finally, calculate the beta.

Calculate the CAPM beta using the formula above.

FAQ

A CAPM beta is a ratio of the return on an investment to the return on the market relative to the return on some risk free asset.