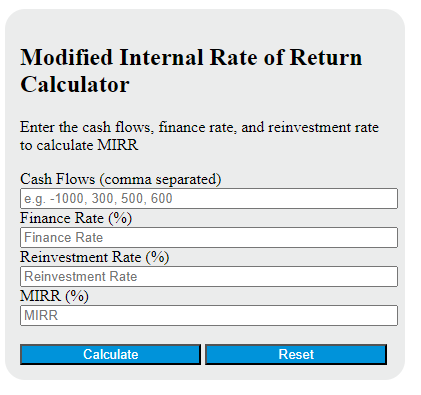

Enter the future value of positive cash flows and the present value of negative cash flows into the calculator to determine the Modified Internal Rate of Return (MIRR), which can also be calculated by inputting any of the variables given the others are known.

- Internal Rate of Return Calculator (IRR) up to 5 years

- Expected Rate of Return Calculator

- Required Rate of Return Calculator

Mirr Formula

The following formula is used to calculate the Modified Internal Rate of Return (MIRR) in a financial calculator:

MIRR = left(frac{{FV_{text{positive}}}}{{PV_{text{negative}}}}right)^{frac{1}{n}} - 1Variables:

- MIRR is the Modified Internal Rate of Return

- FVpositive is the future value of positive cash flows

- PVnegative is the present value of negative cash flows

- n is the total number of periods

To calculate the MIRR, divide the future value of positive cash flows by the present value of negative cash flows. Then, raise the quotient to the power of the reciprocal of the total number of periods and subtract 1 from the result.

What is a Mirr?

A MIRR (Modified Internal Rate of Return) is a financial metric used in capital budgeting and corporate finance. It is a modification of the traditional internal rate of return (IRR) calculation, which addresses some of the IRR’s limitations. The MIRR considers both the cost of the investment (the finance rate) and the interest received on the reinvestment of cash (the reinvestment rate). It assumes that positive cash flows are reinvested at the reinvestment rate and the initial outlays are financed at the finance rate. Therefore, MIRR more accurately reflects the cost and profitability of a project. It provides a more realistic projection of an investment’s profitability, making it a useful tool for comparing different investment opportunities.

How to Calculate Mirr?

The following steps outline how to calculate the Modified Internal Rate of Return (MIRR).

- First, determine the initial investment ($).

- Next, determine the cash inflows ($).

- Next, determine the cash outflows ($).

- Next, determine the discount rate (%).

- Next, calculate the present value of the cash inflows.

- Next, calculate the present value of the cash outflows.

- Next, calculate the future value of the cash inflows.

- Next, calculate the future value of the cash outflows.

- Next, calculate the MIRR using the formula: MIRR = (FV of cash inflows / PV of cash outflows)^(1/n) – 1.

- Finally, calculate the MIRR.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Initial investment ($) = 5000

Cash inflows ($) = 2000, 3000, 4000

Cash outflows ($) = 1000, 2000, 3000

Discount rate (%) = 10