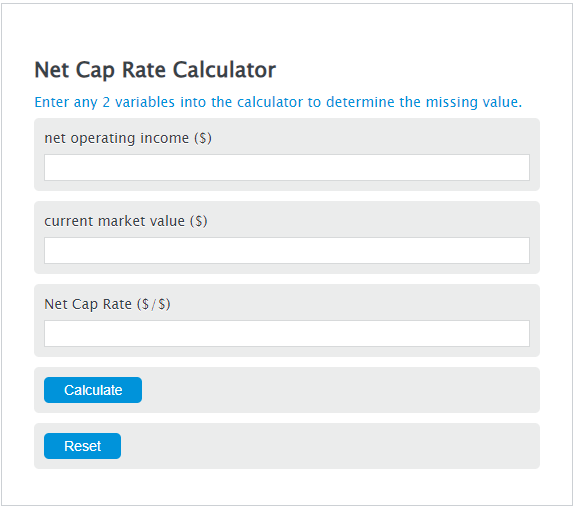

Enter the net operating income ($) and the current market value ($) into the Calculator. The calculator will evaluate the Net Cap Rate.

Net Cap Rate Formula

NCR = NOI / CMV

Variables:

- NCR is the Net Cap Rate ($/$)

- NOI is the net operating income ($)

- CMV is the current market value ($)

To calculate the Net Cap Rate, divide the net operating income by the current market value.

How to Calculate Net Cap Rate?

The following steps outline how to calculate the Net Cap Rate.

- First, determine the net operating income ($).

- Next, determine the current market value ($).

- Next, gather the formula from above = NCR = NOI / CMV.

- Finally, calculate the Net Cap Rate.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

net operating income ($) = 768

current market value ($) = 1200

FAQs

What is Net Operating Income (NOI)?

Net Operating Income (NOI) is a calculation used to analyze the profitability of income-generating real estate investments. NOI equals all revenue from the property minus all reasonably necessary operating expenses.

Why is the Net Cap Rate important in real estate investments?

The Net Capitalization Rate (Net Cap Rate) is a key metric used by real estate investors to evaluate the return on investment of a property. It helps in comparing the relative value of properties by measuring the net income generated relative to the property’s market value.

How can the current market value (CMV) of a property be determined?

The Current Market Value (CMV) of a property can be determined through various methods including comparative market analysis, professional appraisals, or using automated valuation models (AVMs) that analyze public property and market data.

Can the Net Cap Rate formula be used for any type of property?

Yes, the Net Cap Rate formula can be applied to any type of income-generating property, including commercial, residential, and industrial properties. It is a versatile tool for assessing the profitability and investment potential of real estate assets.