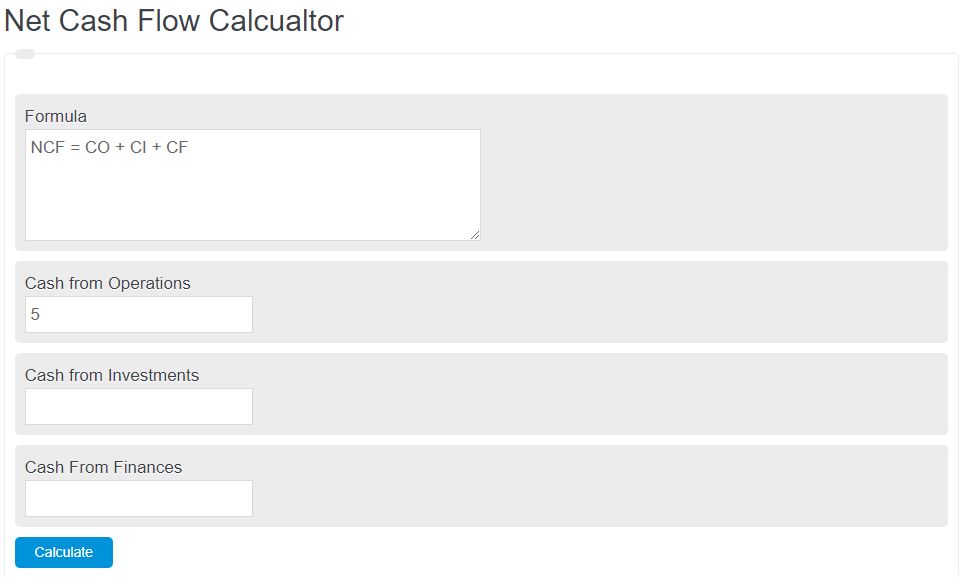

Enter the cash flow from operations, cash flow from investing, and cash flow from financing. The calculator will determine the net cash flow.

- Free Cash Flow Calculator

- Cash Ratio Calculator

- Actual Cash Value Calculator

- Income Investing Calculator

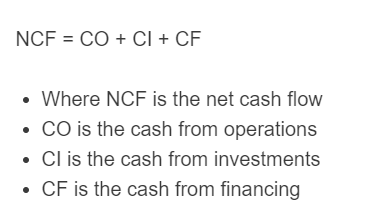

Net Cash Flow Formula

The following equation is used to calculate the net cash flow of a business.

NCF = CO + CI + CF

- Where NCF is the net cash flow

- CO is the cash from operations

- CI is the cash from investments

- CF is the cash from financing

Net Cash Flow Definition

Net Cash Flow refers to the overall cash movement into or out of business during a specific period. It is a crucial financial metric that indicates the net change in a company’s cash position resulting from its operational, investing, and financing activities.

Net Cash Flow measures the cash generated or used by a business, providing valuable insights into its financial health and sustainability.

It reflects the company’s ability to generate sufficient cash to cover operational expenses, invest in growth opportunities, repay debts, or distribute dividends to shareholders.

By analyzing Net Cash Flow, stakeholders can assess the effectiveness of a company’s cash management and its capacity to meet its financial obligations.

A positive net cash flow suggests that a business generates more cash than it is spending, indicating a healthy financial state and potential for growth.

A negative net cash flow indicates that a company spends more cash than it generates. This situation may raise concerns about the business’s ability to sustain its current operations or meet its financial obligations.

Net Cash Flow Example

How to calculate a net cash flow?

- First, determine the total cash from operations.

Calculate the cash generated from operations.

- Next, determine the cash from investments.

Calculate the cash generated from investments.

- Next, determine the cash from financing.

Calculate the cash generated from financing.

- Finally, calculate the net cash flow.

Calculate the net cash flow using the formula above.

FAQ

What determines a healthy cash flow for a business?

A healthy cash flow is when a business generates more cash than it spends, allowing it to cover its operational expenses, invest in growth opportunities, repay debts, and potentially distribute dividends to shareholders.

How can negative net cash flow affect a company?

Negative net cash flow indicates that a company is spending more cash than it generates. This could lead to financial difficulties, including the inability to cover operational costs, invest in new projects, or meet debt obligations, potentially leading to insolvency if not addressed.

Why is net cash flow important for investors?

Net cash flow provides investors with insight into a company’s financial health, its ability to generate cash, and its capacity to maintain or grow operations. It helps investors assess the risk and potential return on their investment.

Can a company have a positive net cash flow but still be in financial trouble?

Yes, a company can have a positive net cash flow while facing financial issues. This can occur if the positive cash flow is not sustainable due to non-recurring financing activities or if the company is not generating enough cash from its core business operations to support long-term growth.