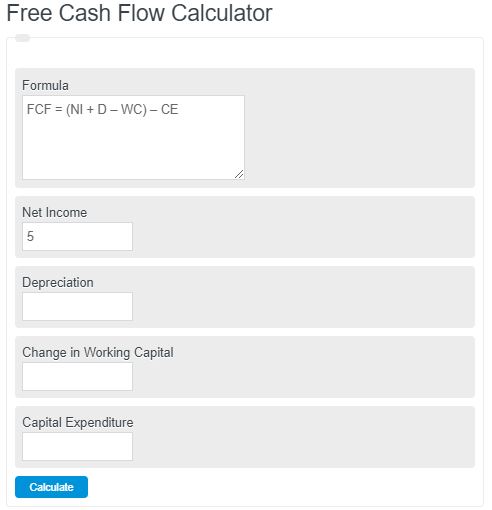

Enter the net income, capital expenditures, depreciation, and changes in working capital into the calculator. The calculator will evaluate and display the free cash flow.

- Max Revenue Calculator

- Cross Price Elasticity Calculator

- Net Profit Margin Calculator

- Cash Coverage Ratio Calculator

- OCF (Operating Cash Flow) Calculator

Free Cash Flow Formula

The following equation can be used to calculate the free cash flow of a business.

FCF = (NI + D – WC) – CE

- Where FCF is free cash flow

- NI is net income

- D is deprecation

- WC is a change in working capital

- CE is capital expenditure

Free Cash Flow Definition

Free cash flow is a financial metric that indicates the amount of cash a company generates after deducting its operating expenses and capital expenditures. It represents the cash available to the company for various purposes, such as expansion, debt payment, dividends, or investment in new projects.

Free Cash Flow Example

How to calculate free cash flow?

- First, determine the net operating income

This will be your total revenue generated by your business.

- Next, determine the depreciation

Determine the total value of deprecation of the assets in your business.

- Next, determine the change in working capital

Calculate your change in working capital over the time period being analyzed.

- Next, determine the capital expenditures

This should be equal to your total operating expenses.

- Finally, calculate the free cash flow

Calculate the free cash flow of your business or asset using the information from steps 1-4 and the formula above.

FAQ

What is the difference between Free Cash Flow and Net Income?

Free Cash Flow (FCF) is the amount of cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Net Income, on the other hand, is the profit a company makes after all expenses, taxes, and costs have been subtracted from total revenue. FCF takes into account investments in capital expenditures and changes in working capital, offering a clearer picture of a company’s cash profitability and liquidity.

Why is Free Cash Flow important for investors?

Free Cash Flow is crucial for investors as it provides a more accurate measure of a company’s financial performance, health, and its ability to generate cash from operations. It indicates how much cash is available for distribution among shareholders, reinvestment in the business, debt reduction, or other uses. A positive FCF can signal a company’s strong position to pursue opportunities without needing external financing.

How can a company improve its Free Cash Flow?

A company can improve its Free Cash Flow by increasing revenues, reducing costs, efficiently managing its working capital, and strategically planning its capital expenditures. Improving operational efficiency and optimizing inventory management can also lead to better cash flow management. Additionally, renegotiating terms with suppliers and customers to speed up receivables and delay payables without compromising relationships can positively impact FCF.

Can a company have a positive Net Income and negative Free Cash Flow?

Yes, it is possible for a company to have a positive Net Income and a negative Free Cash Flow. This situation can arise when a company has made significant investments in capital expenditures or if there’s a substantial increase in working capital requirements. While the company may be profitable on an accrual basis, these investments and changes can result in a cash outflow, leading to negative Free Cash Flow.