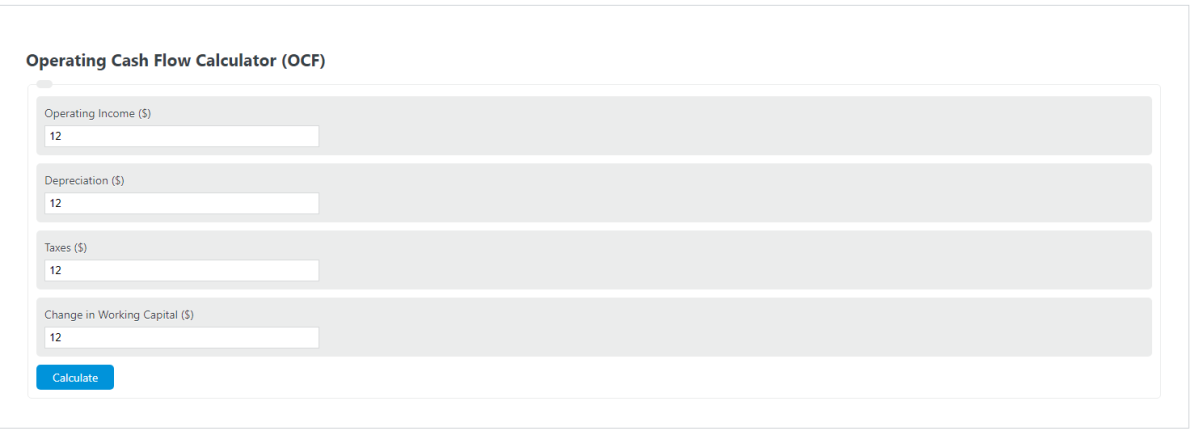

Enter the operating income, depreciation expense, taxes, and the change in working capital to determine the operating cash flow (OCF).

- Free Cash Flow Calculator

- Operating Margin Calculator

- Operating Expense Calculator

- Net Cash Flow Calculator

- Change in Net Working Capital Calculator

- Unit Operating Cost Calculator

Operating Cash Flow Formula

The following formula is used to calculate the operating cash flow of a business.

OFC= OI + D - T + CWC

- Where OFC is the oeprating cash flow ($)

- OI is the operating income ($)

- D is the depreciation ($)

- T is the taxes ($)

- CWC is the change in working capital ($)

OCF Definition

OFC, short for operating cash flow, is a term used in business and finance to describe the amount of cash that is generated by a business’s typical operating.

This means the cash flow does not include any cash flows from investments etc unless the core of the business is actually investing.

OCF Example Problem

How to calculate operating cash flow (OCF)?

First, determine the total operating income earned through the business’s normal operations. For this example, the business earns a yearly amount of $500,000.00.

Next, determine the depreciation on assets owned by the company. In this case, the business has few depreciation assets, and it only amounts to $40,000.00.

Next, determine the taxes that need to be paid on the income. To simplify this example will use a flat rate of $100,000.00 as an example.

Next, determine the change in net working capital. After the year period, the change in working capital is found to be $30,000.00.

Finally, calculate the operating cash flow using the formula above:

OFC= OI + D – T + CWC

OFC= $500,000 + $40,000 – $100,000 + $30,000

OFC= $470,000.00.