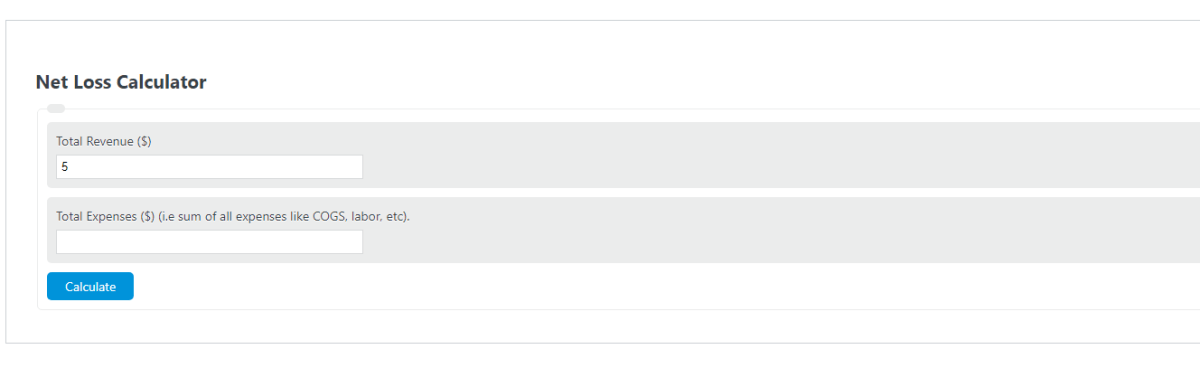

Enter the total revenue and total expenses into the calculator to determine the net loss of a business or business sector.

- Net Profit Calculator

- Net Profit Margin Calculator

- Sales Growth Calculator

- Net Run Rate Calculator

- Capital Gains Loss Calculator

Net Loss Formula

The following formula is used to calculate a net loss.

L = R - E

- Where L is the net loss ($)

- R is the revenue ($)

- E is the expenses

To calculate net losses, subtract the net expenses from the net revenue.

Net Loss Definition

A net loss is defined as the total monetary loss of a business over a given time period. It can also be described as the total revenue minus the total expenses.

When analyzing a loss, the revenue minus expenses should come out negative. For example, $200 revenue and $300 expenses would be -$100 net loss. You can switch the equation around if you prefer to work with positive numbers. Just make sure that you are understanding this is still a loss.

Example Problem

How to calculate net loss?

For this example, we will analyze the net loss of a candy store over a one-month period.

First, determine the total revenue of the shop. For this problem, 1000 candy bars were sold at an average price of $5.00. To calculate the total revenue the number of units sold is multiplied by the average price to get $5,000.00.

Next, determine the total expenses. This includes the cost of the candy bars, the cost of the labor to man the shop, and any other overhead costs. For this problem, the candy bars’ COGS was $2.00 each, which would be $2,000 total at the 1000 units sold, the labor for the month was $2,000.00, and the overhead of the store (i.e. rent/AC cost/etc.) was $2,000.00.

Finally, calculate the net loss using the formula above.

L = R – E

= $5,000.00 – ($2,000+$2,000+$2,000)

= $5,000 – $6,000

= – $1000.00 net loss

FAQ

Is net loss the same as net profit?

The net loss and net profit of a business are calculated using the same formula, and therefore the terms can be used to mean the same thing.

Net loss is most often used when talking about a negative value when using the formula above and a net profit is used when that value is positive.

What happens if a business has a net loss?

Depending on the time period or stage of a business, a net loss is not necessarily a bad thing.

For example, if a company is in an early-stage startup stage, then the company is likely spending lots of money to grow as fast as possible without regard to making a profit. In this case, as long as the invested money is covering losses, it is ok.

If, however, you are looking at a long-term steady-state company like a restaurant, then running at a loss for an extended period of time will cause the business to go bankrupt if it cannot receive further funding.