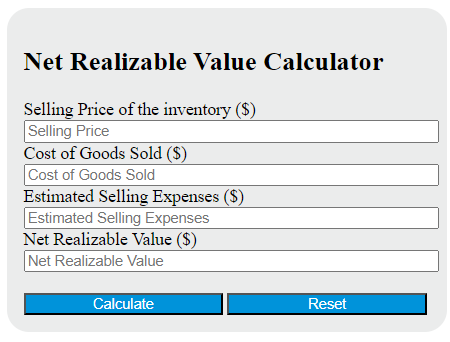

Enter the Selling Price, Cost of Goods Sold, and Estimated Selling Expenses into the calculator to determine the Net Realizable Value. This calculator can also evaluate any of the variables given the others are known.

- Recapture Depreciation Calculator

- Cost To Retail Ratio Calculator

- Unadjusted Cost of Goods Sold Calculator

Net Realizable Value Formula

The following formula is used to calculate the Net Realizable Value (NRV).

NRV = SP - COGS - E

Variables:

- NRV is the Net Realizable Value ($)

- SP is the Selling Price of the inventory ($)

- COGS is the Cost of Goods Sold ($)

- E is the Estimated Selling Expenses ($)

To calculate the Net Realizable Value, subtract the Cost of Goods Sold and the Estimated Selling Expenses from the Selling Price of the inventory.

What is a Net Realizable Value?

Net Realizable Value (NRV) is a financial metric used to determine the estimated selling price of an asset, minus any costs associated with the eventual sale or disposal of the asset. It is used in the valuation of inventory to ensure that inventory is not overvalued and reflects potential losses from items that may not be sold at their full value. NRV is a conservative valuation method, providing a worst-case scenario for the asset’s value.

How to Calculate Net Realizable Value?

The following steps outline how to calculate the Net Realizable Value (NRV).

- First, determine the Selling Price of the inventory (SP) ($).

- Next, determine the Cost of Goods Sold (COGS) ($).

- Next, determine the Estimated Selling Expenses (E) ($).

- Next, gather the formula from above = NRV = SP – COGS – E.

- Finally, calculate the Net Realizable Value (NRV).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Selling Price of the inventory (SP) ($) = 150

Cost of Goods Sold (COGS) ($) = 80

Estimated Selling Expenses (E) ($) = 10