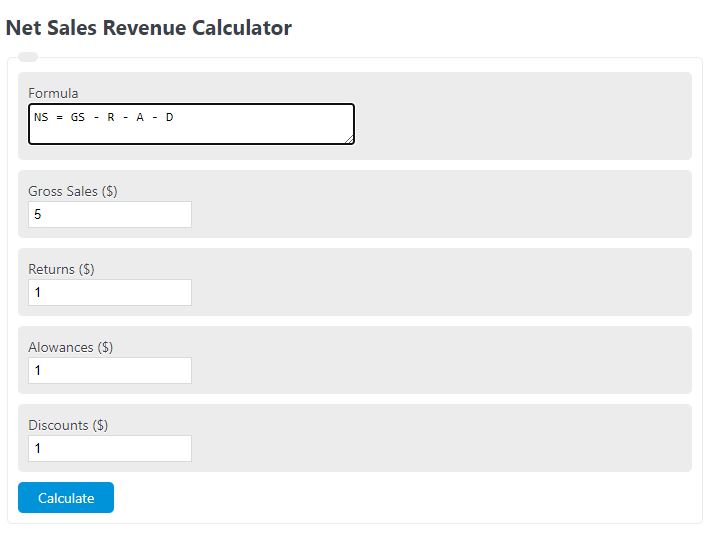

Enter the gross sales, total returns, allowances, and discounts into the calculator to determine the net sales revenue.

- All Revenue Calculators

- Cost of Sales Calculator

- Net Profit Calculator

- Percent of Sales Calculator

- Return on Sales Calculator

Net Sales Revenue Formula

The following formula is used to calculate net sales revenue.

NS = GS - R - A - D

- Where NS is the net sales revenue

- GS is the gross sales

- R is the total returns

- A is the allowances

- D is the discounts

To calculate the net sales revenue, subtract the returns, allowances, and discounts from the gross sales.

Net Sales Revenue Definition

A net sales revenue is a measure of the total sales revenue minus returns, allowances, and discounts.

Net Sales Revenue Example

How to calculate net sales revenue?

- First, determine the gross sales.

For this example, we will say the gross sales is $1,000.00.

- Next, determine the total returns.

This is the value of all returns. We find this to be $50.00.

- Next, determine the total allowance.

We find this value to be $75.00.

- Next determine the total discounts.

We find this value to be $50.00.

- Finally, calculate the net sales revenue

Using the formula we find the net sales revenue = $825.00

FAQ

How do returns, allowances, and discounts affect net sales revenue?Returns, allowances, and discounts decrease the gross sales figure to arrive at net sales revenue. They are deductions that reflect the cost of unsold goods, price reductions, and promotional offers, respectively.

Why is calculating net sales revenue important for a business?Calculating net sales revenue is crucial for understanding the actual revenue generated from sales activities. It helps in assessing the financial health of a business, making informed decisions, and strategizing for future growth.

Can net sales revenue be negative?Typically, net sales revenue is a positive number, indicating the amount of sales income retained after deductions. However, in rare cases where returns, allowances, and discounts exceed gross sales, it could theoretically be negative, indicating a loss in sales activities.