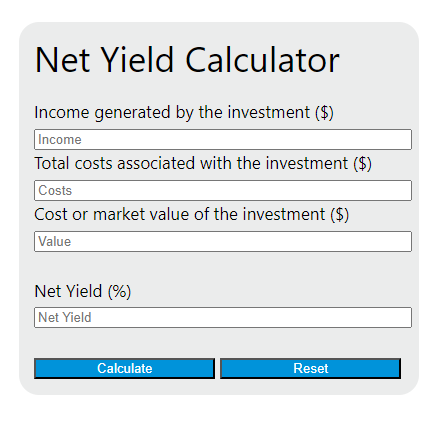

Enter the income generated by the investment, total costs associated with the investment, and the cost or market value of the investment into the calculator to determine the net yield.

Net Yield Formula

The following formula is used to calculate the net yield on an investment.

NY = (I - C) / V * 100

Variables:

- NY is the net yield (%)

- I is the income generated by the investment ($)

- C is the total costs associated with the investment, including operating expenses, taxes, and fees ($)

- V is the cost or market value of the investment ($)

To calculate the net yield, subtract the total costs associated with the investment from the income generated by the investment. Then, divide the result by the cost or market value of the investment. Multiply the quotient by 100 to express the net yield as a percentage.

What is a Net Yield?

Net yield refers to the income return on an investment after accounting for all costs associated with the investment, including operating expenses, taxes, and fees. It is typically expressed as a percentage of the investment’s cost or market value. Net yield is a more accurate reflection of the actual return on an investment as it takes into account all associated costs, unlike gross yield which only considers the income generated by the investment.

How to Calculate Net Yield?

The following steps outline how to calculate the Net Yield.

- First, determine the income generated by the investment ($).

- Next, determine the total costs associated with the investment, including operating expenses, taxes, and fees ($).

- Next, gather the formula from above = NY = (I – C) / V * 100.

- Finally, calculate the Net Yield.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

income generated by the investment ($) = 500

total costs associated with the investment, including operating expenses, taxes, and fees ($) = 200

cost or market value of the investment ($) = 1000